Week in Review

This week saw oil prices retake a few important thresholds. Crude climbed back above $50/bbl, and diesel prices closed above $1.90 on Thursday. While stock market jitters could cause a return to lower prices in the coming weeks, many are tentatively saying that Dec 27’s $44/bbl close was the bottom of the recent prolonged bear market.

Two major developments helped push prices higher this week. First, the US and China appear to be making progress on trade talks. Their two-day meeting was extended to a third day, which wouldn’t have happened unless there had been progress to build on. Although neither country has provided concrete details of an agreement, sentiments have been positive. Chinese diplomats shared that they had made significant progress towards a resolution, while American negotiators boasted that China had committed to purchasing more American goods. An end of the trade war would be a stimulus to both economies, contributing to higher oil prices.

The other development came from Saudi Arabia, who committed to cutting production even further than required under the OPEC agreement. Previously committing to 500 kbpd cuts, the Saudis are now moving towards 800 kbpd cuts. The Saudi budget is built around Brent oil prices being $80/bbl, so without higher prices, they will not be able to spend as normal. For them, 800 kbpd is less than 10% of their total production – if they can influence prices to rise 50% by cutting 10% of their sales, it’s a clear financial win.

Prices in Review

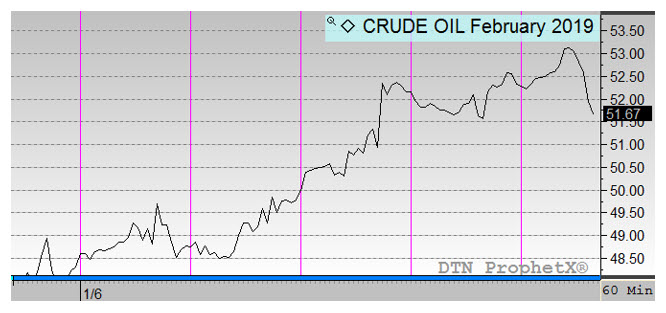

Crude prices rose steadily this morning, outside of some losses on Friday morning. Crude began the week at $48.30, having risen from late-December lows. Each day brought gains this week, leading to a Friday opening price of $52.28, a $4/bbl (8.2%) gain.

Diesel prices also experienced steady gains throughout the week, building on gains from the prior week. Diesel opened at $1.7809, recovering from $1.65 the week before. By the end of the week, crude had climbed to open Friday at $1.8995 – up 11.9 cents (6.7%) for the week.

While gasoline failed to deliver the lofty returns seen by crude and diesel, it still is solidly in the black for the week. Beginning at $1.3560, prices began working their way to a high-point of $1.44 before sliding back. This morning, gasoline prices opened at $1.4215, a gain of 6.6 cents (4.8%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.