Week in Review

Prices have been fluctuating wildly this week – with massive gains giving way to rapid losses. Markets are in untested territory. As we’ve noted before, the $70-$75 range for WTI is one of the least common price levels over the past three years. Prices only pass through this range when shooting higher (2009) or plummeting lower (2014).

For technical traders (who use statistical models to find market patterns that repeat over and over), the lack of historical activity in this range leaves prices open to fluctuate largely. Based on historical trends, prices move rapidly through $70-$75, so why should this time be different? Markets have more room to run the higher prices get, which is why we’ve seen $1-$2 market swings per day rather than smaller fluctuations. Until markets get more comfortable with the $70 range, or until they move to a more comfortable range – expect volatility to continue.

Price Review

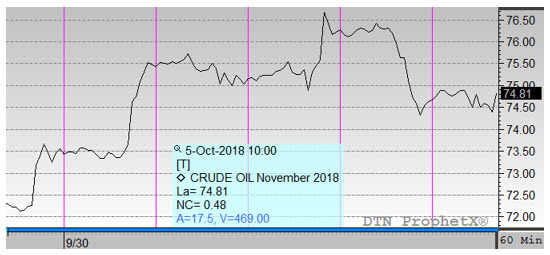

After a lumpy week of increases and declines, WTI crude prices remain in the black for the week, but far from their high water mark. Crude began the week at $73.29, already a high level compared to recent weeks. Prices quickly ramped up during the week despite a lack of strong bullish news – in fact, prices hit a new multi-year high of $76.90 on the day the EIA showed an 8 million barrel crude build! Yesterday brought lower prices as inflation concerns picked up, which strengthened the dollar. Prices opened this morning at $74.67 – well below the high point of the week but still a weekly gain of $1.38 (1.9%), a relatively large weekly increase.

Like crude, fuel prices saw early week gains followed by a Thursday reversal. Diesel prices began the week at $2.3531, quickly jumping above $2.40 by the end of Monday’s trading session. Prices remained at that level for most of the week, increasing as high as $2.45 on Wednesday before dropping lower. This morning diesel opened at $2.4024, a weekly gain of 4.9 cents (2.1%).

Gasoline prices are the most at risk of dropping to a net loss for the week. Gasoline began the week at $2.0908, picking up 3 cents on Monday and reaching a weekly high of $2.15 on Wednesday before reversing lower. This morning, gasoline opened at $2.1105, a gain of 2.0 cents (0.9%), though prices have dropped a bit lower during morning trading.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.