Week in Review

Another week is set to end in the red, this time with the trend somewhat supported by short-term bearish fundamentals. Crude oil inventories were the talk of the trade this week, gaining 6 million barrels compared to an expected draw of 3 million barrels – a 9 million barrel swing! The culprit was increased imports on the East Coast and West Coast, though it’s unclear whether those changes mark a new trend or simply a blip.

Also notable this week, Cushing stocks rose for the first time since May, when Canada’s Syncrude facility fell offline. With production resumed and normal operations expected to be achieved by September, Cushing may finally have an opportunity to re-stock its lost supplies, which are at the lowest point since 2014.

WTI futures prices remain in backwardation (meaning future prices are below prompt month prices), yet Brent crude is in contango (meaning future prices are above prompt month prices). Typically the two oil contracts have similar curve dynamics – their main differentiator is location.

Contango curves incentivize suppliers to put fuel into storage because they can earn more in the future, while backwardation incentivizes them to empty their storage because they’ll make more money selling now. Thus, while contango looks like prices will rise (picture a price chart with the arrow going up and right), it’s actually bearish. WTI’s backwardated structure suggests that inventories could continue to fall for a bit longer, causing prices to rise. Until that structure flips, WTI probably has a bit more room to run, though not a lot more room before catching up to Brent.

Price Review

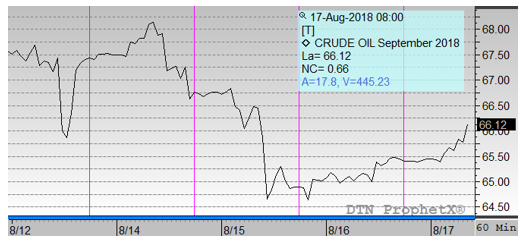

Crude oil began the week at $67.78 and saw some small losses on Monday, but the big losses didn’t occur until Tuesday and Wednesday following the EIA’s report. Since then markets have been trying to recover, but it’s been slow going. Crude opened this morning at $65.47, a loss of $2.31 (-3.4%).

Diesel also fell this week, though the losses were a bit less pronounced. Monday saw an odd blip in prices but was generally flat. Tuesday was bullish for prices, but gains could not withstand the EIA’s report, causing prices to drop. Diesel opened at $2.0964 this morning, a loss of 4.8 cents (-2.2%).

Gasoline’s losses fell between crude and diesel – the product dropped below $2/gal for the second time in the last few months, showing normal end-of-summer weakness. Gas opened at $2.0411 but fell quickly below $2/bbl; this morning prices opened at just $1.9872, a loss of 5.4 cents (2.6%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.