Week in Review

Weeks like this one have grown increasingly common – prices approach $70, then crater. Market volatility continues, as can be expected, with markets still favoring the $65-70 price range. The week had its ups and downs, with tariffs driving much of the bearishness. US-China trade war rhetoric continues to be thrown back and forth, and though crude has been exempted from the conversation, the overall economic impacts cannot be ignored.

Adding to the bearish news was the US decision not to impose sanctions on Venezuela. Ever since the re-election of Venezuelan leader Maduro, the US has been considering sanctions. Given the rapid descent of the country’s economy and oil output, though, sanctions have become unnecessary. Oil production in particular has collapsed, falling from over 2 million barrels per day in 2016 to 1.5 million barrels per day, with further losses expected as the year continues. US sanctions threatened to accelerate the collapse, so markets are breathing a sigh of relief that Venezuelan production will continue to just decline steadily, rather than falling off all at once.

On the flip side, the first wave of Iran sanctions went into effect early this week, creating upward pressure on oil prices. As we noted earlier this week, Iran has survived even harsher sanctions in the past, so there’s no reason to expect them to break under Trump’s sanctions. This time, they have the rest of the world to trade with, keeping them afloat. That doesn’t mean there won’t be an impact from sanctions on oil production – analysts expect roughly 1 million barrels per day of oil to fall off the market by November. As we draw closer to November, expect markets to begin creeping prices up.

Price Review

Crude prices have been creeping higher over the past couple weeks, but they once again experienced a large one-day change that brought them down. WTI crude opened the week at $68.65 and traded as high as $69.92 on Monday, but a bearish demand outlook for fuels caused prices to plummet on Wednesday. Crude spent the remainder of the week treading water, with prices opening on Friday at $66.74, a loss of nearly $2/bbl (-2.8%) for the week.

Diesel prices also had a big drop this week after rising to nearly $2.17 early in the week. Prices opened at $2.1281 and rose rapidly, but after Wednesday’s losses prices have been mostly flat. Diesel opened on Friday at $2.1091, a loss of under 2 cents (-0.9%). Diesel’s strength comes as we head into fall/winter with much lower inventories than we’ve seen the past few years.

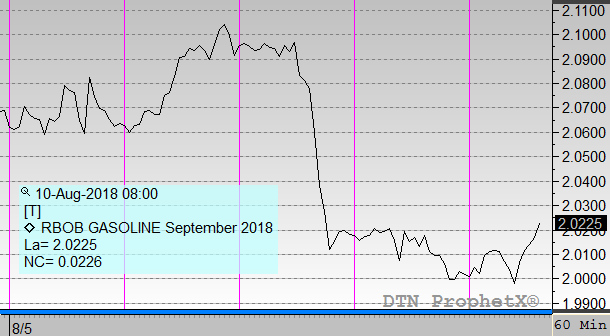

Gasoline was certainly the biggest loser of the week, once again. Summer demand was nearly half a million barrels down this week compared to the same time last year, and high inventories all summer long have ensured gasoline prices didn’t break higher. Gasoline opened the week at $2.0664, reaching as high as $2.10 before Wednesday’s collapse. Prices opened this morning at $2.0015, losing roughly 6.5 cents (-3.1%) for the week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.