Week in Review

Welcome to oil markets, where the news is made up and the prices don’t matter!

Okay, perhaps an exaggeration, but there’s been a lot of price changes this week based on speculation rather than concrete changes in fundamentals. President Trump has played a significant role in directing prices over the past few weeks, and this week was no exception. Everything from Iran, to China, to domestic CAFÉ standards have perpetuated a market frenzy in which prices can turn in an instant, as we saw nearly every day this week.

In political news, Trump continued to escalate his threats against China, now increasing the proposed tariff from 10% to 25% imposed on $200 billion of Chinese goods. The proposed tariffs would have a significant trade-reducing affect, causing an economic slowdown that would directly impact oil demand while also driving China to buy more oil from Iran. On the other hand, Trump has also proposed a change to CAFÉ standards, meaning vehicles over the next 10 years will likely consume decidedly more fuel than previously forecast – which promotes higher future prices.

On the geopolitical side, Saudi Arabia resumed deliveries through the Bab el-Mandeb Strait after an attack by Iran-backed Houthi rebels last week. As Iran sanctions approach, markets are concerned about rhetoric from Iranian leaders threatening to shut down key chokepoints in the global oil trade. The Bab el-Mandeb Strait is the 5th most important chokepoint in the world; the Strait of Hormuz, another chokepoint Iran has threatened, facilitates one-third of maritime oil transportation. While no actual blockade has begun, markets are just nervous enough that risk premiums will likely continue through at least November.

Fundamentally, the only concrete data we have from this week was the EIA report, which showed a large build in crude and diesel stocks along with a gasoline draw. Yet gasoline has seen some of the lowest prices of the week, while crude and diesel both rebounded strongly yesterday. Markets have been somewhat skeptical of the EIA’s data – crude stocks drew sharply last week, then gained this week, and early estimates show another steep draw next week. With markets globally near balance, this continued “will they/won’t they” of supply fundamentals ensures further market volatility in the near-term.

Fuel Price Overview

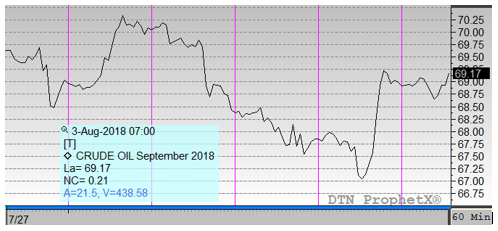

Crude prices opened the week at $69.01, and quickly ebbed up above $70/bbl on Monday before reverting lower on Tuesday. The losses continued through Thursday morning, then pulled a surprise reversal and shot up to just shy of $69. Prices opened this morning at $68.99 – a whopping 2 cents below Monday’s opening price.

Diesel’s recovery was a bit less enthusiastic than crude – opening the week at $2.1568, prices this morning opened at just $2.1267, a three cent loss (-1.5%). Beginning the week, diesel prices rose much less quickly than crude did, though it enjoyed a similar decline on Tuesday and Wednesday. Inventory builds caused prices to decline, but the prospect of diesel fuel efficiency remaining lower over the next decade helped spur a rally on Thursday.

Gasoline was by far the biggest loser of the week despite its notable inventory draw on Wednesday. Gasoline prices opened at $2.1652 on Monday – and opened at just $2.0631 today, a loss of over 10 cents (-4.7%). We’re past the worst for summer gasoline demand, and the EIA has forecast that gasoline prices will remain below their May highs for the rest of the year. Gasoline’s “recovery” yesterday was quite modest, causing it to fall behind the rest of the market.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.