Week in Review

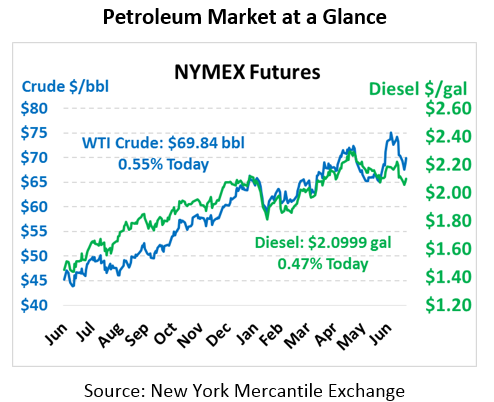

After Monday’s large decline, crude prices have increased slowly and steadily closing each day slightly higher. This morning, prices continue to show meager gains with crude gaining 38 cents to trade at $69.84 currently.

Fuel prices are also trending higher after their minor losses yesterday. Both gasoline and diesel experienced some volatile movement yesterday before closing mostly flat, losing less than a penny from opening prices. This morning, gasoline prices are $2.0645, a gain of over 2 cents. Diesel prices are $2.0999, an increase of almost a penny.

Week in Review

This week opened significantly lower, with crude shedding $2/bbl and fuel prices losing 8-10 cents. Since then, however, prices have been trending towards recovery, with steady gains the rest of the week.

The big news on Monday driving prices lower was the rumor that Trump might release oil from America’s Strategic Petroleum Reserve to help lower prices before the midterm. Of course, these rumors had little evidence to substantiate them, so markets can only wait and see if they materialize. A release from the SPR would have just a short-term impact on markets, but it could keep prices lower for the next month or so.

Additionally, production outages globally are coming to their end. Libya is back online, though they’ve had some hiccups following a kidnapping, which shut one port in the middle of the week. Saudi Arabia and Russia both increased production last month, but this week they clarified they have no intention of flooding the market with oil, giving prices a boost. In Canada, efforts to restart Suncor’s Syncrude operation and restore the 360 kbpd of crude output are continuing, with the first 150 kbpd of production expected to return by the end of the month.

The EIA reported American crude production reaching record highs of 11 million barrels, which mixed with lower refinery utilization meant lower crude oil prices. However, lower refinery utilization also meant less fuel being produced, keeping gasoline and diesel prices elevated.

Weekly Price Review

WTI crude oil began the week at $70.52, but quickly plummeted on Monday down to nearly $68 – a single-day loss of 3.5%. Markets spent Tuesday processing the massive loss and seeking a new direction. By Wednesday, markets decided that higher was the direction to go, and slowly began a rise that would bring crude above $70 once again by Friday morning. Friday opened at $69.39, a loss for the week of $1.13 (-1.6%), but gains this morning could potentially close the price gap.

Like crude oil, diesel prices fell 3.3% on Monday, trended sideways on Tuesday, and began to trend higher by Wednesday. The EIA gave diesel prices a large boost, thanks to refinery runs mostly cutting back diesel product supplies. Diesel opened the week at $2.1255 and quickly lost seven cents; this morning prices opened at $2.0922, a weekly loss of 1.6%. Like crude, though, diesel prices are rising this morning to close the gap between Monday’s opening price and today’s closing price.

Gasoline saw the biggest losses of the week, with Monday’s sell-off causing 10-cent losses compared to last Friday’s close – 4.5% losses in a single day. The EIA’s report of moderate inventory draws helped markets recover somewhat from the quick move, but gasoline has struggled to regain its massive losses. Gasoline opened this morning 2.2% below Monday’s opening price, and despite significant gains this morning prices will struggle to regain their weekly opening price above $2.09.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.