Week in Review

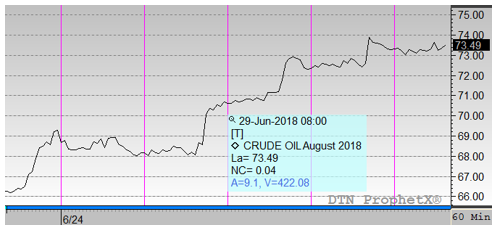

Up…up…and away! That’s the best way to describe oil markets this week, which flipped prices from $68/bbl on Monday to well over $73/bbl this morning. A few key factors went into driving prices back to multi-year highs:

- Iran sanctions. With America’s withdrawal from the Iran nuclear deal, sanctions are being imposed on international businesses doing work with Iran. The State Department has been very strict with its enforcement, saying that every country must comply with the sanctions or face the loss of American business. While some countries may still buy Iranian oil, most are siding with the U.S., meaning the functional loss of Iranian supply is around 600,000 barrels per day. As far as supply outages go, Venezuelan and Libyan production is also on the decline.

- OPEC’s production increase. Increased production generally causes prices to fall – that’s basic supply and demand fundamentals. However, markets hyped up the potential for OPEC’s increase, then OPEC failed to clarify how they’d achieve their new plan (which was basically to bring production back up to the quotas they agreed to last year). Saudi Arabia and Russia would have to disproportionately increase their production – which they’re prepared to do, but Iran and other countries may protest. So prices fell lower before the announcement, but afterwards markets were disappointed by the increases, causing prices to correct higher.

- Canadian Syncrude production. Canada’s Syncrude production experienced an outage that is expected to last through the end of July. Syncrude produces around 350,000 barrels per day, most of which is shipped to Cushing, OK. With that supply off the market, WTI crude prices are tightening, helping to close the gap between Brent-WTI crude from over $10 last week to just $5 this week.

- Inventory data. On Wednesday, the EIA reported the largest crude inventory draw since 2016, a whopping 9.9 million barrel draw. Exports reached a record high 3 million barrels per day (21 barrels per week), and refinery utilization climbed to its highest point since 2001. It’s highly unlikely next week’s number will be quite so dramatic given the closing of the Brent-WTI spread, which will result in fewer exports. Still, the Syncrude outage will likely drive inventory draws at Cushing, driving the market higher.

Weekly Price Review

WTI crude prices began the week at $68.75, the high end of the previous week’s range of $65-$68. Monday saw prices decline slightly, but since then the trend has been towards markedly higher prices. Tuesday and Wednesday both saw gains of more than $2/bbl, and by Wednesday’s close WTI crude had hit a new multi-year high at $72.76. Prices continued climbing to reach an opening price of $73.33 this morning, a gain of about $4.50 (6.7%) for the week.

Diesel prices also got a sharp boost this week, no thanks to a small inventory build reported by the EIA. Underlying crude prices were the true catalyst, causing diesel prices to rise from $2.1186 on Monday to $2.1752 this morning, a much smaller 5.7 cent (2.7%) gain for the week.

Gasoline performed slightly better than diesel, though gasoline prices are still trailing behind. Gasoline opened at $2.0652, dropping lower on Monday but subsequently rising each day throughout the week. By this morning, prices had risen to $2.1335, a gain of 6.8 cents (3.3%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.