Week in Review

Oil markets gyrated between $64/bbl and $66/bbl, switching directions after every OPEC headline. The organization is meeting today to decide whether to increase production. Saudi Arabia and Russia support a 1 million barrel per day increase in production quotas, while Iran and Venezuela oppose any changes. Markets are expecting a middle-of-the-road decision from the group, helping to give prices a lift this morning. If OPEC announces a larger increase (or, less likely, no increase at all), markets would likely jump into action and correct prices.

Trump’s tariffs on China were also a major driver this week, leading prices lower as oil markets feared a decrease in demand. More importantly, China could potentially put tariffs on American oil, reducing demand for WTI crude and lowering its prices. On-going negotiations with China will determine the future fate of oil trades.

Weekly Price Review

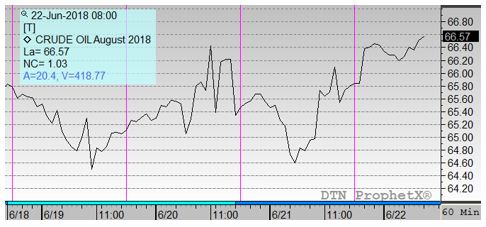

Crude oil moved up, down, and back up again this week, showing weekly gains that could only be disrupted by OPEC announcing a larger-than-expected supply increase. Crude opened the week on Monday at $64.40; this morning prices opened at $65.93, a $1.51 (2.3%) gain for the week. The EIA’s report of steep crude stock draws helped give prices a lift on Wednesday, which kept crude relatively stronger than fuel prices.

Diesel prices are eking out some gains this morning, but are unlikely to overcome a week of losses. A diesel inventory build and reduced demand sent diesel plummeting this week from its $2.13 highs. Diesel began the week at $2.08, and quickly rose higher before reverting lower on Wednesday. Losses were amplified in the latter half of the week, and diesel prices this morning opened at $2.076, a meager loss of 0.4 cents that’s flipped to gains in early trading this morning.

Last, gasoline also struggled to take any meaningful action this week. Prices opened Monday at $2.0151, and opened this morning at $2.0175. The product has been a stone’s throw away from falling below $2/gal, and yesterday did very briefly dip below the line. Like diesel, gasoline inventories rose this week while demand fell, creating a generally bearish attitude for markets.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.