Week in Review

Crude prices are very close to where they began the week, despite mid-week weakness. This week, markets remained focused on rising oil inventories (not including diesel stocks), and the upcoming decision from Trump on the Iran nuclear deal.

The Federal Reserve met earlier this week to discuss interest rates. A decision was made on Wednesday to leave the federal fund rates untouched. The buzz around the meeting kept oil traders conservative on Tuesday and Wednesday while a stronger dollar put downward pressure on prices.

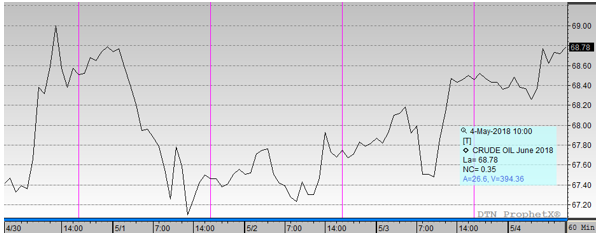

Crude oil opened the week at $68.15, and opened this morning 35 cents, and opened this morning higher at $68.50. Crude peaked at a high of $69.34 on Monday before trading within a mostly narrow range of $67-68/bbl for the remainder of the week. Crude will most likely end the week in the black.

Unlike crude oil, diesel prices saw losses this week, despite another weekly diesel inventory draw. Diesel opened the week at $2.15, opening this morning just over $2.11. Although it has recovered some of its mid-week losses, diesel will likely end the week in the red.

Gasoline Could also end the week in negative territory. NYMEX gasoline prices began the week at $2.11, and opened this morning at $2.09. The 2.2-cent loss represents a 1.0% decrease in prices this week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.