Week in Review

What a week it’s been for prices! Crude prices soared this week, reaching new three-year gains as WTI crude prices approached $70/bbl.

The catalyst for these higher prices was Wednesday’s oil market data, which showed across-the-board inventory draws and record high gasoline demand. The second factor is particularly notable, since we’re still a couple months from the peak of summer demand season. If we’re setting records in April, who knows how high demand could go during the summer!

While markets focused on fundamentals this week, the bigger threat comes from the upcoming need to renew sanction waivers for Iran. On May 12, the President will have to re-approve the Iran deal, which many expect will not happen. IF sanctions are reimposed on Iran, it could take a portion of their oil production off the market, causing prices to ratchet up even higher.

Market Review

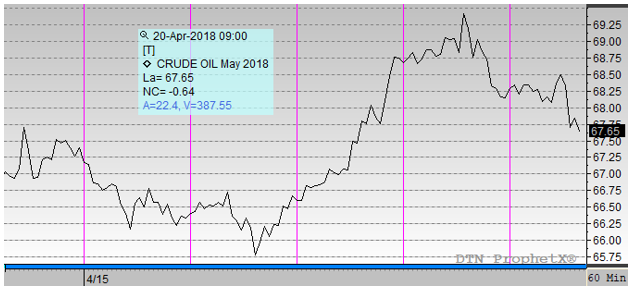

WTI crude prices saw quite a run-up in prices this week, opening the week at $67.24 and sinking as low as $65.56 on Tuesday before skyrocketing up to a high of $69.56 on Friday. Prices opened at $68.26 this morning, giving a weekly price change of $1.02 (1.5%). Of course, losses incurred so far today may cause the week’s overall price impact to be smaller/flat.

While crude prices were hitting three-year records, diesel markets were a bit quieter. Diesel certainly saw notable gains this week, but they have yet to surpass the $2.14 highs seen in January. As a result, although crude prices are tearing higher, diesel prices are still somewhat of a bargain relative to earlier this year.

Diesel prices began the week at $2.10, opening this morning at $2.12, a gain of 0.8%. Prices peaked as high as $2.1285 yesterday but have been trending lower towards negative ground. Currently, prices are slightly in the red for the week, although the trading day is far from over.

Gasoline prices were less excitable, gaining just 0.5% as prices rose from an opening price of $2.065 on Monday to $2.077 this morning. Although prices have not quite reached negative territory for the week, they are on their way.

Gasoline ought to have seen stronger price gains this week in response to inventory draws and such strong demand. Of course, gasoline supplies have been relatively abundant throughout the winter, so coming into the spring markets are not convinced they need to worry about supply imbalances just yet. If strong demand continues, expect to see gasoline prices trade a bit higher relative to crude prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.