Week in Review

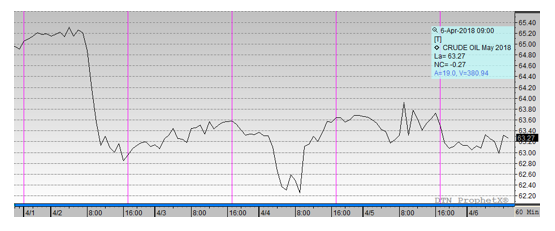

Markets enjoyed a fairly quiet week, save for Monday’s precipitous drop which took roughly $2/bbl off the price of crude. Monday’s sell-off was a result of on-going concerns that the U.S. and China are careening towards a trade war, with both countries announcing tariffs on $50 bn work of goods exchanged. Markets are unsure whether the escalation is the art of the deal, or instead more of Trump’s impulsive behavior.

Since then, market-driving news has been fairly light at a macro level. Some tensions between Saudi Arabia and Iran have prompted a bit of a rally mid-week, but the effects have waned since then.

The weekly inventory data was supportive for prices, with both crude and diesel inventories falling, while gasoline held to just a small build. Strong export data also pitched in to prop up prices. But stock builds in Cushing, OK, the point of reference for WTI crude oil, kept a damper on any upward price activity.

Despite a week of timid macroeconomic changes, at the fuel price level, renewable markets have had quite the turbulent week. In March, the EPA announced they would waive about half of their renewable volume obligation for a Philadelphia refinery that had declared bankruptcy. This week, the agency issued more waivers to small refineries, even though the small refineries are owned by massive companies like Andeavor.

The waivers suggest the EPA may reconsider the Renewable Fuels Standard down the road, since they’ve now conceded the policy causes broad-based economic hardship for refineries. What that means for the future of alternative fuels like ethanol, biodiesel, and renewable diesel is unclear. The decisions have caused renewable fuel prices to plummet, which has a muted effect on consumers, for instance, since ethanol is only 10% of gasoline bought at the pump, a ten-cent change in ethanol prices means only a 1-cent savings on gasoline.

Crude prices began the week at $64.91, and opened this morning at $63.70, a loss of $1.21 (-1.9%). The majority of the losses came from Monday’s steep decline; prices actually rose slightly between Tuesday’s opening price and today’s.

Diesel prices trended similarly to crude prices, falling Monday, but a key difference is that prices have not picked up in the latter half of the week, especially given today’s declining prices. Diesel prices fell nearly 4 cents (-2.0%) between Monday and today, with prices opening this morning at $1.98.

Gasoline has seen a bit of extra volatility thanks to changes in RINs prices, but the overall trend has been in line with crude and diesel prices. Gasoline lost roughly 2.3 cents (-1.1%), with a bigger gain occurring on Wednesday thanks to a smaller stock build than the API had forecast.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.