Week in Review

Fuel price risk is alive and kicking this week, with prices skyrocketing this week from $62.23 to a high of $65.74 on Thursday, falling back to $64.28 to open this morning. Lately, analysts (including us) have mentioned the correlation between the stock market and crude oil, two markets that are generally more independent. Yesterday’s major stock selloff contributed to the oil market’s losses of $1.20, but in general fears of a global trade war and geopolitical instability are causing the two markets to diverge.

Oil markets hate uncertainty, so fears over the Iran deal and Venezuela (and with John Bolton’s appointment, even North Korea) are adding significant risk premiums to the futures market. We noted recently that futures markets had slipped into slight contango, which is a technical indicator that generally accompanies downward price trends. That trend has reversed once more to backwardation, which is bullish for oil markets and investors.

Inventories Lead Rally

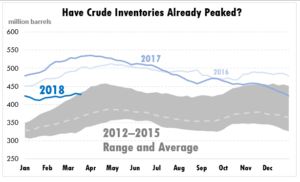

An inventory build on Wednesday, surprised markets, kicking off this week’s rally. Crude inventories typically build during the first few months of the year and slip into a drawing pattern through the spring and summer. Usually, the inflection point comes in April or May, though it’s come early in the past. With all the risk factors in the market, combined with OPEC’s on-going production cuts, markets are fearful the inflection has come early and inventories could fall from here.

Of course, some draws can occur before the market fully switches to a destocking pattern. Crude inventories could continue to rise. But even if they do, inventories likely will not rise much longer. With 2018 inventories far lower than 2016-17 levels, markets are fearful of how far they could fall during the summer. Lower inventories would mean strong upward pressure on oil prices – as inventories approach the 2012-2015 average price, it’s possible prices could be supported in the high $60s or even low $70s by the end of the year.

Price Review

After a big correction in February reversed January’s gains, it only took a week to get crude prices back up to their high January levels. Prices soared on Wednesday thanks to the EIA’s reported crude draw, leading to a one-day increase of nearly $1.50. Overall the weekly gains have been $2/bbl, a 3.3% price increase for the week.

Diesel prices have been the market leader for the week, rocketing almost 8 cents (4.2%) higher to open this morning at $1.9923. Diesel prices have been testing the $2/gal level since Wednesday, consolidating support to push prices higher. All this comes after starting the week at just $1.91, and diesel prices were in the mid $1.80s last week. The trend has generally been following crude , though declining diesel inventories have helped give diesel an extra boost relative to crude.

Gasoline prices have been another big winner this week, gaining 6.3 cents (3.2%) throughout the week. Gasoline began the week at $1.94, and sank as low as $1.92 before hitting a high of $2.04 this morning. Today’s opening price of $2.00 shows that both fuel types, gasoline and diesel, are positioning themselves to rise above the $2/gal threshold.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.