Week in Review

Markets have turned around this week, with the stock market rising and commodities prices both rising in response to a lower dollar this week. Although the week got off to a rocky start, oil prices are returning to their previously high levels. This morning, WTI crude opened above $61 for the first time since last week. Whether or not oil will make its way back to $65 is yet to be seen.

The week changed courses on Wednesday when the EIA showed an overall inventory draw across all oil-based products and a below-expectation crude build. The overall draw halted oil’s decline and helped it reach higher ground. On the flip side, lower refinery utilization will reduce the demand for crude oil, while also causing refined fuel inventories to fall while refineries go through maintenance.

While there hasn’t been a lot of market-moving news this week outside of the EIA report, there has been some speculation regarding OPEC. Saudi Arabia’s oil minister noted this week that OPEC would rather over-shoot five-year average inventory levels than end the cuts early. OPEC’s deal extension came with a potential escape clause if markets are already balanced by June; markets have wondered whether OPEC will use that to end the deal early. The oil minister’s comments gave the market some assurance that the deal will continue this year even if OPEC sends inventories plummeting too low. At the same time, the UAE’s Minister of Energy mentioned that plans are underway to sign a long-term OPEC framework for oil supply management.

Product Overview

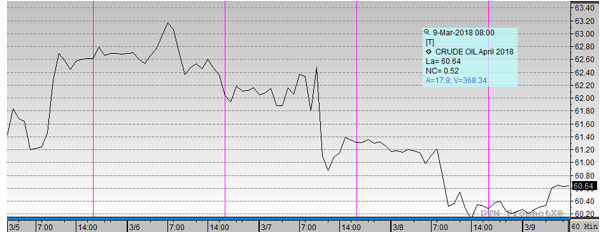

Crude oil prices began the week at $59.12, more than 9% below last week’s opening price. Markets reached a low point of $58.20 on Wednesday morning, but rallied after the EIA’s report of a smaller-than-expected crude inventory build. A draw in Cushing, OK inventories also helped give prices a boost. Prices surpassed $60/bbl on Wednesday, and opened this morning at $61.45, a gain of $2.33 (3.9%) for the week.

Diesel prices traded in line with crude oil this week. Opening at $1.8510, prices bottomed out at $1.8084 on Wednesday, the lowest prices have gone since October 2017. Today, prices opened significantly higher at $1.8944. Overall, diesel prices rose 4.3 cents, or 2.3% – slower than crude’s gains, but still a reversal from last week’s downward trend.

Gasoline prices opened the week at $1.7029, the lowest weekly open since mid-December. Unlike crude and diesel prices, gasoline prices bottomed out on Tuesday at $1.6519, making Wednesday’s bounce a bit less pronounced in the chart. Still, gasoline ended the week at $1.7426, a 4 cent (and 2.3%) gain.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.