Week in Review

Markets did end last week thoroughly in the red, shedding $1.06, but markets are on track to add that and more back this week with a strong performance. Markets remain enthusiastic, and fundamentals seem to support at least some of the enthusiasm. Crude stocks are ignoring seasonal trends and falling, while demand forecasts are growing more robust. It’s been a growth month, with crude prices continuing to set new three-year highs.

Crude oil began the week at $63.61, lower than it began the previous week but certainly not “low” when you look back at the last few months. Markets rose slowly during the week, slowed by a reported inventory build according to the API, but prices soared following the EIA’s report of a stock draw. Prices opening this morning at $65.25, a bit lower than yesterday but still the second highest opening price in three years. Overall, the week yielded a gain of $1.64, or 2.6%.

Diesel prices have been following crude prices higher, with nearly five cents (2.4%) in gains. Expected to have a stock draw this week, the EIA reported a small diesel inventory build, but you wouldn’t know it from looking at the charts. Markets have enthusiastically followed crude higher, buoyed by reports of declining refinery run rates as maintenance begins. Prices opened this morning at $2.1111, 4.7 cents higher than Monday’s opening and (like crude) nearly a three-year high opening price.

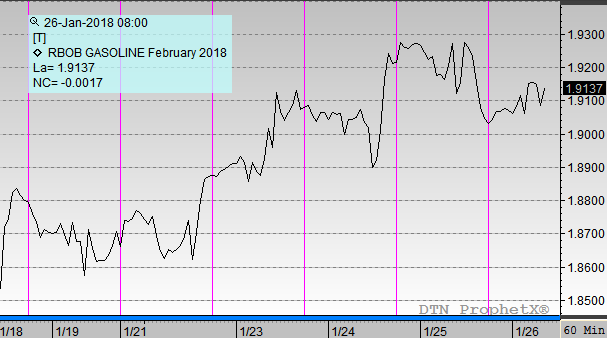

Dragging behind the market has been gasoline prices, which traded with mixed sentiment during the week. Gasoline prices rose 3.75 cents during the week, and Thursday saw some of the highest prices since gasoline surpassed $2.00 during Hurricane Harvey. A larger than expected stock build helped keep gains relatively lower than crude or diesel prices – gasoline prices rose just 2.0% this week, a bit slower than other products.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.