Week in Review

After five straight weeks of steady gains that have brought WTI crude prices a whopping $6 higher (over 10% gains in just a month), it looks like markets are set to break their winning streak. Crude prices are down 70 cents (1.1%) this morning compared to Tuesday’s opening price. Analysts are increasingly warning that crude contracts are overbought, and that a correction is in order. Whether this week’s slowdown is the beginning of a correction or simply a brief speed bump on the path to $70 is yet to be seen.

Crude prices began the week at $64.43, the highest opening price in several years. Since opening, prices have steadily fallen lower, finding some support in the middle of the week but ultimately dropping lower. Despite a relatively strong crude draw, prices fell on Thursday, leaving prices far lower than they closed last week. Given the size of the weekly losses, a rebound to positive territory seems unlikely this week (though anything is possible).

Diesel fuel moved in line with crude oil during the week, though with more exaggerated losses of 1.4%. Like crude, diesel inventories saw a large draw this week, which isn’t surprising given the strong demand for heating oil in the past few weeks. What is surprising is that even large draws were not enough to keep diesel prices elevated – signifying that for diesel, the strongly bullish market may have fizzled out.

Diesel began the week at $2.0913, and this morning opened at $2.0620, a loss of nearly 3 cents. Most of the losses came at the beginning of the week, with a slightly downward trend re-emerging as the week comes to an end.

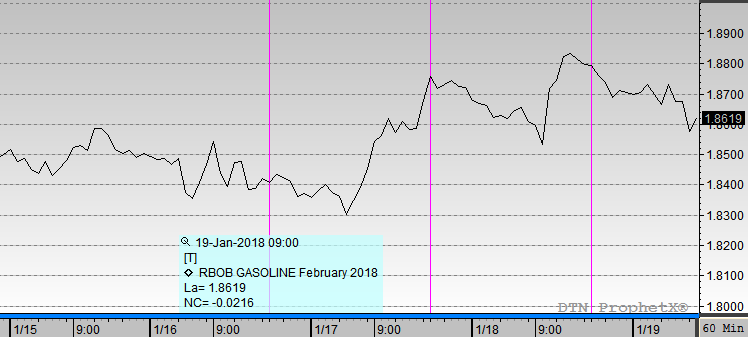

Gasoline has been bucking the trend, supported by Gulf Coast refinery outages caused by winter freezes. Despite markets trending lower this morning, it’s safe to say that prices will remain in the black this week. Gasoline prices rose 4.6 cents, or 2.5%, between today’s opening price and Tuesday’s beginning.

Gasoline prices began the week at $1.8500. Strong price gains came on Wednesday and Thursday despite stock builds, buoyed by reduced refinery run rates. Today, the market opened at $1.8810, though prices are currently trading a bit lower.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.