Week in Review

It’s been another week of large gains for crude oil, with prices gaining $1.96 between Monday’s opening price and this morning. The New Year is continuing its trend to push prices higher with crude oil posting a three year high closing price on Thursday. After the API reported massive inventory draws, the EIA report seemed minimal in comparison. However, inventories continue to draw during a time that inventories historically build, which provided support for WTI crude prices. Also of note, Brent hit a peak of $70 for the first time since 2014, leading Lukeoil’s CEO to state that Russia should exit the OPEC deal if Brent prices remain over $70 a barrel for over six months. The statement introduced some slight uncertainty in the market since the new cuts are set to remain until December.

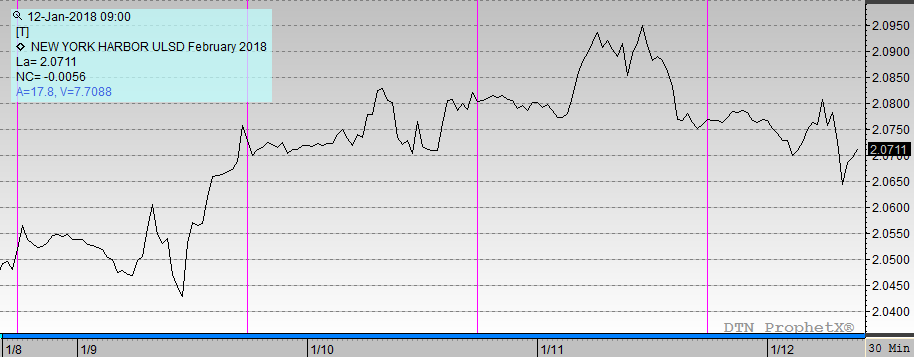

Diesel began the week at $2.0600, and opened this morning at $2.0770, a gain of over a penny. Monday saw diesel prices shed 0.7%, or 1.5 cents, as temperatures warm up across the country and heating oil demand falls. Tuesday, diesel began its gradual hike in prices that continued throughout the week. On Wednesday, the EIA reported a stock build of 4.3 MMbbls for diesel even though there was a decline in production and refinery utilization. Despite losses this morning, prices should end the week slightly higher overall.

Gasoline saw large gains this week of over 4.5 cents since Monday’s opening price. Prices began the week at $1.7892, and opened this morning at $1.8095. Like diesel, gasoline prices have weakened this morning, but after a week of strong gains are in line to end the week higher. Gasoline inventories also built this week by 4.1 MMbbs; however, the stock build did not slow the market in pushing prices higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.