Week in Review

It’s been a calm week for the oil complex, with markets overall picking up some small gains. News this week has been light, as is common for a major holiday week.

Crude oil picked up 84 cents between Monday’s opening price and today’s open, a gain of 1.5%. Prices this morning were $58.21. The overall trend this week has been towards higher ground, partially reversing losses of $1.65 over the past three weeks.

Last week, markets received a slew of bearish commentary from the IEA and EIA showing that markets would be oversupplied in the first half of 2018. That news saw prices dip into the $56 range last week, giving them room to move a bit higher to reach the $57 markets have been comfortable with lately. That price adjustment, combined with a larger than expected crude inventory draw this week, helped to support markets.

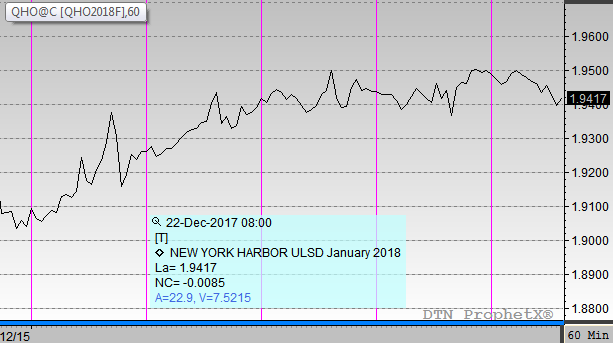

Diesel picked up some stronger gains this week, adding 4.6 cents (2.4%) between Monday morning and today. Most of the gains were achieved earlier in the week, with markets up 3.5 cents by Tuesday’s close. Since then, diesel prices have trended flat to slightly higher, staying in that comfortable $1.90-$1.95 range.

Since the beginning of December, diesel prices have closed below $1.90 just three times. Whenever prices dip below the line, a round of buying boosts prices back above that comfortable threshold. Diesel fundamentals have been extremely strong, with strong exports and above-average diesel demand both helping to draw down diesel inventories. A surprise build on Wednesday showed that refineries are managing to keep up with demand. December typically sees some large inventory builds, so markets did not react too negatively to the surprise build.

Gasoline is certainly the biggest winner of the winner of the week, picking up almost 9 cents, a huge 5.4% change in one week. Despite posting some huge gains, gasoline’s rise should not be too surprising – in the past four weeks, prices fell from $1.78 down to $1.65. Given rising crude and diesel prices, mixed with improving fundamentals and below-expected inventory builds, a resurgence of gasoline prices was to be expected.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.