Week in Review

As we close the week, it looks like prices could once again close for a loss, which would be the third week of losses in a row. Over the past two weeks, prices have fallen from $58.95 all the way to $57.36 last Friday. Prices remain, however, at a higher level relative to the first ten months of the year, a trend unlikely to change before the end of the year.

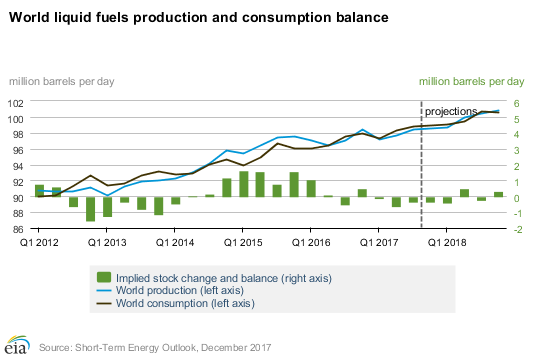

This week has been short on market-moving headlines, so traders have been digging into the fundamentals. Several agencies, including the IEA, EIA and OPEC, reported on global supply and demand trends this week, giving plenty to support both the bulls and the bears. OPEC’s report made little change to previous expectations. The EIA forecasts an increase in U.S. domestic supply in 2018, along with a small upward revision to Chinese demand statistics. Compared to last year, their overall expectations for supply/demand balance in 2018 shifted from consistent oversupply to a more balanced (and bullish) picture, with demand outpacing supply until the second half of the year. Still, the report had a net-bearish slant, as rising U.S. production is offsetting much of OPEC’s cuts.

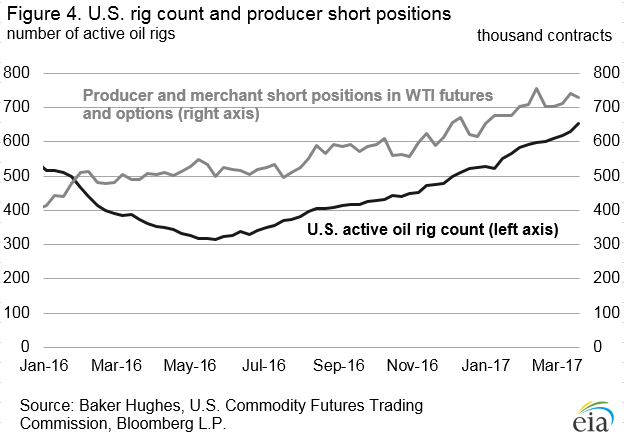

On the other side, the International Energy Agency (IEA) continues to show supply outpacing demand, leading to an over-supplied market in the first half of 2018. Forecasted supply rose, while demand expectations stayed the same as last month. The agency noted that U.S. production was particularly challenging to forecast given the complexity of responses to higher prices – many companies are using higher prices to consolidate their current activities, rather than drill new wells. Since U.S. production is driven by companies beholden to shareholders, rather than controlled by the government, they are less predictable. Overall, however, the agency stated, “[O]ur current outlook 2018 may not necessarily be a happy New Year for those who would like to see a tighter market.”

This week, crude prices opened lower at $57.25, and opened this morning at $57.15, a meager ten-cent loss. Prices are on the rise this morning as well, so it’s likely those gains could be completely wiped out. While much of the fundamental reports were bearish for prices, the EIA did report a sizable stock draw for the week, which helped to temper any downward trends.

Diesel prices also opened today with a net loss for the week, but daily gains could counteract those losses and put the week back in the green. Diesel did show a small draw on Wednesday, which helped to keep losses muted. Overall diesel prices tracked closely with crude oil prices.

Gasoline prices fell 4 cents between Monday’s opening and today’s opening price, and today’s gains are unlikely to bring prices back to positive territory. Wednesday saw a large stock build in the EIA statistics, which caused prices to plummet. Prices have rebounded since then, but have not given up their Tuesday and Wednesday losses.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.