Week in Review

It’s been a hectic week for markets, responding to post-holiday trends and a bearish inventory report, all with OPEC hovering over everyone’s market expectations. Yesterday’s announcement of OPEC’s extension turned into a grand non-issue, with markets closing exactly one cent below their opening price.

Yesterday, OPEC and the coalition of Non-OPEC countries agreed to extend production cuts through the end of 2018, an outcome that the market was anticipating and had already priced into the market. Still, the complete lack of enthusiasm following the announcement could indicate that markets are growing more accustomed to OPEC activity – which may be a problem for the organization when the deal ends. The extension comes with an escape clause if markets get too overheated, with a market review in June.

The API and EIA once again did not line up in their reported inventory stats, though both were bearish for markets. The API showed a crude stock build, rising diesel inventories and a medium-sized gasoline draw. The EIA reported a crude inventory draw, but large builds for refined products. The builds were likely the result of record refinery production for this time of year, the first time refinery input has ever surpassed 17 MMbpd in Q4. Strong refiner margins are incentivizing more and more production of refined products, which should keep consumers well supplied through the winter.

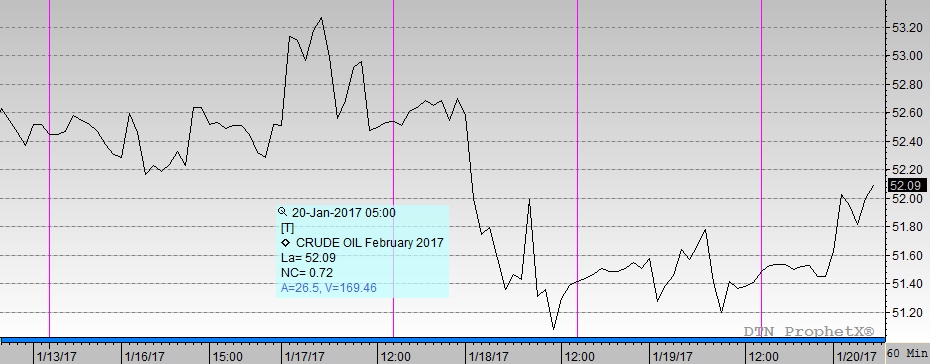

Crude oil prices are lower this week, beginning the week at $58.95 and opening this morning at just $57.42, a 2.6% decline. Of course, last week we expected a comparable price decrease and were surprised by a late-Friday bump in prices, so this week’s outcome is far from certain. Prices saw up-down-up movements on both Wednesday and Thursday thanks to the EIA and OPEC. Strong refinery runs will keep diesel prices elevated for the foreseeable future.

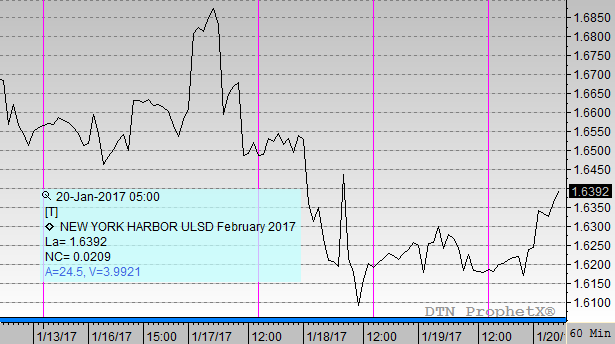

Although diesel price trends look different from this past week, the resulting 2.6% decline (5 cents for diesel) was the same. Prices fell drastically yesterday as markets fully processed the EIA data and OPEC created some market fluctuations. Monday saw diesel prices open at a strong $1.9529, the highest opening price of the week. Four days of losses followed, though today is on an upward bent that could eliminate the losses from this week.

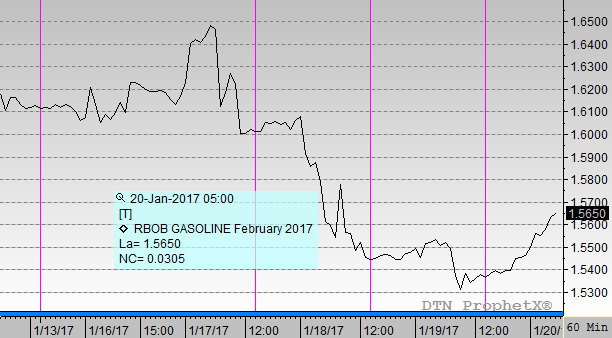

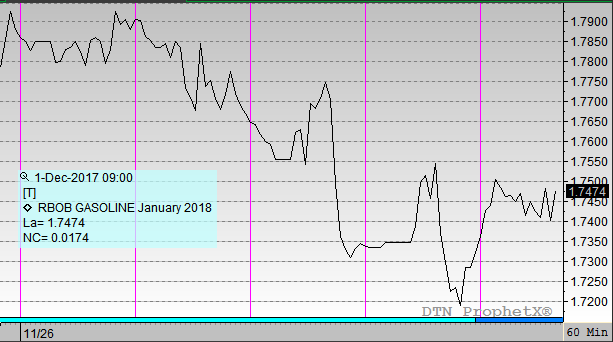

Gasoline has outpaced diesel and crude oil losses, shedding 5.4 cents (3.0%) this week as demand declined by a whopping 800 kbpd this past week. Whether the trend was a pre-holiday blip or signifies a longer trend is yet to be seen. Gasoline prices began the week at $1.7861, and managed to pick up steam early in the week before seeing huge losses on Wednesday. Today prices opened at just $1.7321; unlike crude and diesel, gasoline gains this morning have been muted.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.