Volatility Resumes, Iran Nuclear Deal Appears Dead

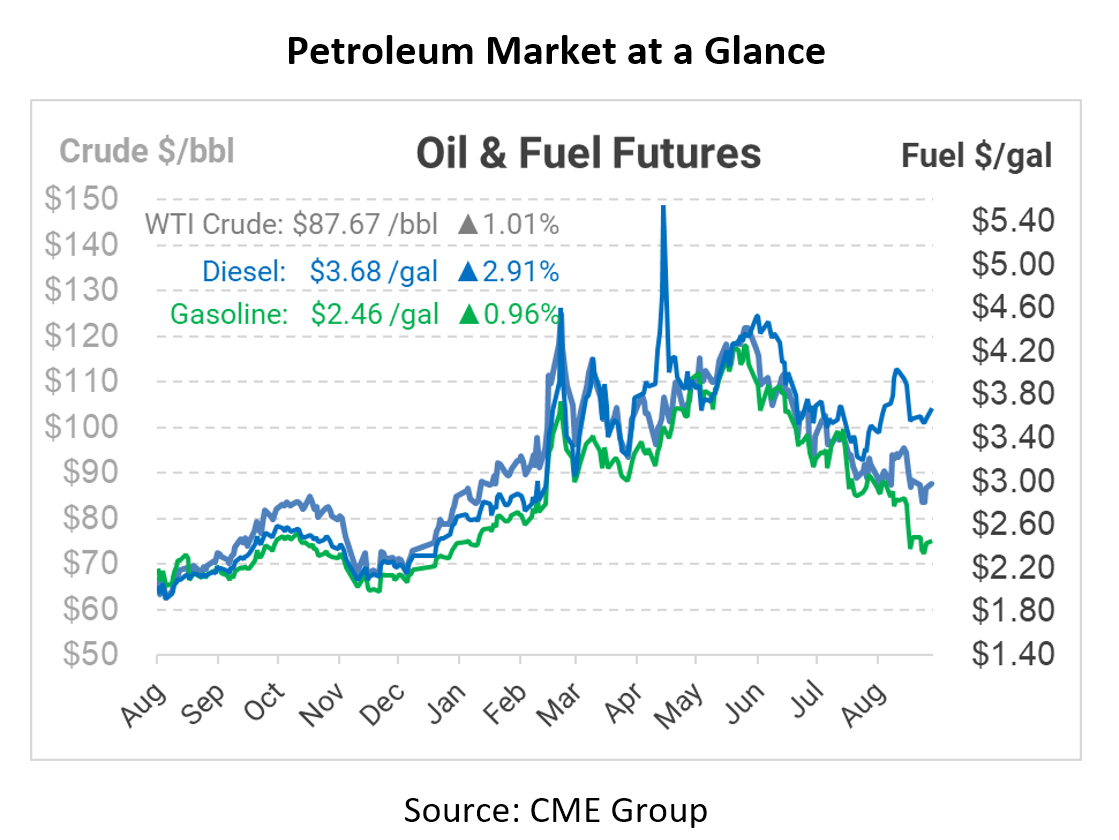

After a relatively slow week, market volatility is back, with prices climbing upwards from last week’s lows. With Russia indefinitely cutting natural gas shipments to Europe via the Nord Stream pipeline, markets are expecting Europe’s power companies to turn to alternatives including coal and oil to generate electricity. Diesel inventories are already at historic lows – European distillate stocks are at the lowest seasonal level since 2002. For that reason, diesel prices are up more than a dime this morning, while crude and gasoline also experience moderate gains.

Adding to market pressure, European officials now claim to have “serious doubts” that an Iran nuclear deal will come to fruition. The deal would lift international sanctions on Iran, allowing over a million barrels of oil to flow to the market; however, the US and Iran have been at an impasse for over a year. European leaders have been trying to broker a deal to allow oil purchases to resume. This week, France, Germany, and the UK published a joint statement noting that Iran’s latest demands stretched negotiators “to the limits of our flexibility.” At the same time, Iran’s stockpile of enriched uranium continues growing.

On the demand front, China continues to dominate headlines with its weak growth. As the world’s largest oil importer, the country is an important source of demand. Their zero-COVID policy, however, has significantly reduced consumption, and analysts now expect oil demand to fall this year for the first time since 2002. Hundreds of millions of Chinese typically travel during two fall holidays, Mid-Autumn Festival on Sept 10 this year and the Golden Week in October, but many are expected to stay home and avoid travel this year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.