Venezuela Sanctions to Cut Crude Imports 500 KBPD

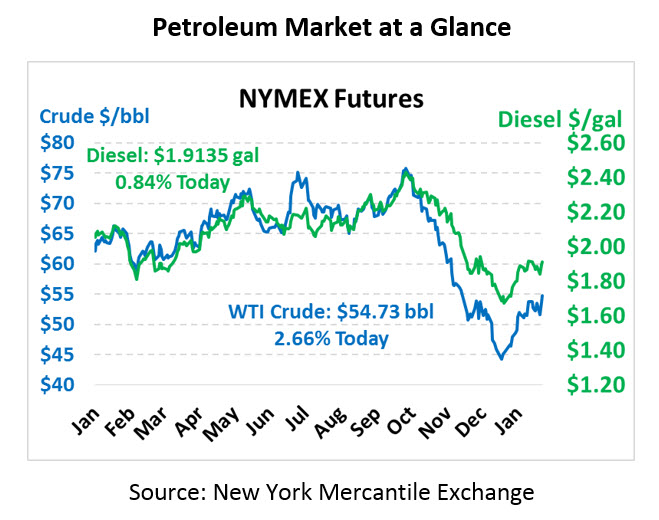

Oil is trading sharply higher this morning after the EIA reported a decidedly bullish inventory change this morning. Prices climbed $1.30 yesterday, and appear on track for gains of a dollar or more this morning. Crude oil is currently trading at 54.73, up $1.42 from yesterday and at the highest level since mid-November.

Fuel prices have also received a shot in the arm, with diesel trading close to 2019 highs. Diesel prices are currently $1.9135, up 1.6 cents since yesterday’s close and within two cents of the highest price seen in 2019. Gasoline prices are trading at $1.4022, up 5.1 cents.

The situation in Venezuela continues to spiral, with Maduro violently cracking down on the opposition while also cutting off internet, radio, and TV communication. The US has set up a special fund to allow companies to continue doing business with PDVSA and Citgo, but paying through a special payment mechanism that funnels the money to opposition leader Guaidó. The latter company reached out to fuel marketers yesterday noting that CITGO will continue business as usual, citing continuity planning for regulatory events, and noted they plan to comply with all US laws during this time. Sanctions will cut off 500 kbpd of crude imports from Venezuela, which Goldman Sachs estimates could add $3/bbl to oil prices if prolonged.

After the API’s report painted a slightly bearish picture last night, the EIA’s report seems even more supportive. While the API reported across-the-board builds, the EIA showed a smaller than expected crude build and draws for both gasoline and diesel. The report also included a draw in Cushing inventories and a sizable decrease in crude imports (down 1.1 MMbpd week-over-week). That import decline does not include the effects of Venezuelan sanctions, so markets are bracing themselves for more sizable draws in the coming weeks as sanctions cut off 3.5 million barrels of oil weeklt.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.