Venezuela, OPEC Import Decline Lifts WTI above $55

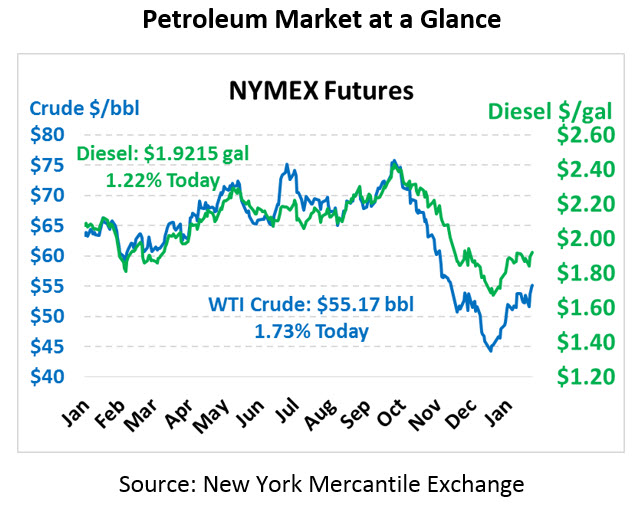

After flirting with the $55/bbl threshold yesterday, oil prices ended slightly lower, but still locking in nearly a dollar in gains. This morning, crude prices continue rising, trading at $55.17 after picking up 94 cents.

Fuel prices are also trending higher. Diesel popped above $1.90 this morning, currently trading at $1.9215 after picking up 2.3 cents. Gasoline prices are trading at $1.4006, up 1.8 cents.

Markets remain concerned that Venezuelan sanctions will have an adverse effect on American oil prices, particularly following reports of a Venezuela-bound oil tanker reversing directions this week. Adding to the tightness is OPEC austerity, with oil ministers sharing months ago that Saudi Arabia planned to target exports to the US with their supply cuts. America has some of the most transparent inventory data in the world, so a draw in American crude stocks will ripple through international oil prices. With Saudi Arabia pushing for oil prices around $80, don’t expect them to loosen their supply restrictions in response to Venezuela sanctions.

Canada announced plans to loosen the 325 kbpd production restriction they placed on Alberta crude production. The restrictions were meant to improve the supply imbalance in the area, where lack of pipelines caused an oil surplus that pushed Canadian crude prices to trade $40 below WTI crude. In February, the government will allow an additional 75 kbpd of production, noting that oil storage levels have already fallen 5 million barrels over the past month.

With Venezuela’s heavy crude off the table, refiners configured to process the heavier crude blends are looking for a near replacement. American WTI crude tends to be much lighter (less dense). The uptick in Canadian production likely won’t help fill the gap since pipelines coming from Canada are already running at capacity. Analysts at RBC Capital noted refiners are more likely to turn to countries such as Iraq and Mexico to get that heavy fuel, potentially at higher prices than Venezuelan crude would have been.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.