US-Iran Tensions Flare Despite COVID-19

In today’s topsy-turvy world, it’s hard to talk about anything other than COVID-19 news, perhaps with the occasional OPEC call-out. But over the last few weeks, tensions have been flaring in the Middle East, and COVID-19 may be right at the heart of the tension.

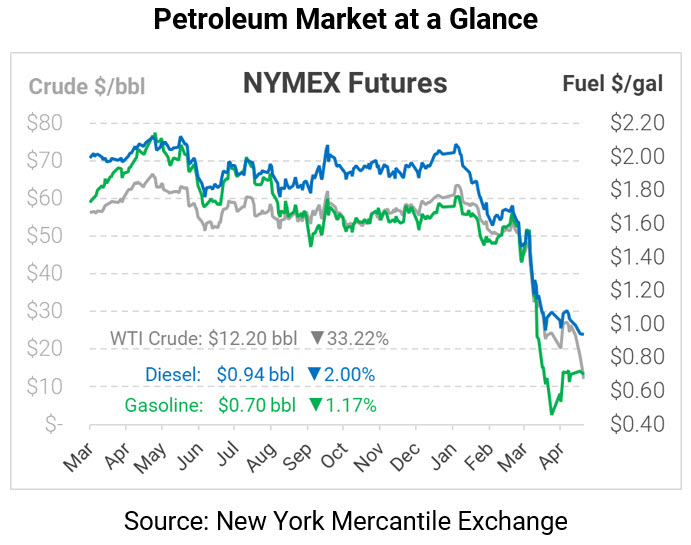

Before we jump into geopolitics, let’s touch on the latest with COVID-19. Crude oil prices are tumbling this morning – trading at just $12 – but it may be a short-lived drop. Recall that NYMEX futures prices are just that – based on future prices. The current contract is May 2020, but tomorrow that contract expires and the market will begin using June 2020 as its new “prompt” month. June’s oil price is currently trading over $10 higher than May, though by EOD tomorrow the two contracts will need to converge. With governors discussing reopening the economy, fuel prices have generally remained supported, indicating that the pressure is technical pressure for WTI Crude and not indicative of a broader oil market sell-off.

Now, on to Iran. Between sanctions, plummeting oil prices, and a particularly hard outbreak of COVID-19, Iran’s economy has been decimated. The economic pressure has enabled hardliners in the Iranian government to consolidate power, emboldening their positioning towards the US. In March, Iranian-backed forces launched an attack in Iraq, killing two Americans. Last week, Iran’s Revolutionary Guard boarded a Hong Kong-flagged oil tanker travelling near the Strait of Hormuz before releasing the vessel. This week, Iranian naval forces held exercises that brought them dangerously close to American warships, and both sides have alleged the other was the aggressor.

Normally, this much saber rattling would cause a huge increase in oil prices. Today, no Middle Eastern war could possibly disrupt enough oil to bring markets into balance, so oil markets are indifferent towards the geopolitical risk.

Eventually, the COVID-19 crisis will pass, and markets will return to normal. When that occurs, the market will be left with a massive overhang of excess petroleum inventories, but it will also have all of the same fights and conflicts we held in the past. As the world calls for ceasefires and peace amid the coronavirus, it appears some conflicts are finding ways to continue unabated.

Today, WTI crude oil is dropping quickly despite moderate losses for the rest of the complex. WTI crude is trading down at $12.20, a massive $6.07 (33%) decline – setting a new record for largest percentage drop in a day. It’s worth noting that Brent Crude is down just over $1/gal today.

Fuel prices are tracking closer to Brent Crude rather than following WTI. Diesel prices are trading at $0.9372, down 1.9 cents. Gasoline prices are currently $.7024, down 0.8 cents.

This article is part of COVID-19

Tagged: Geopolitics, Iran, Middle East

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.