US Government Agrees on $1.2 Trillion Infrastructure Bill

Yesterday, President Biden and a group of bipartisan senators agreed on a $1.2 trillion infrastructure package, including $579 billion in new spending. Biden had previously proposed a larger bill, which included an emphasis on what’s been called “human infrastructure,” including in-home care, child care, and more. The bipartisan bill will cover more traditional infrastructure projects like roads and highways, with only $15 billion going towards clean energy and electric vehicles. Among other funding sources, such as stricter IRS enforcement, the bill would sell $6 billion from the Strategic Petroleum Reserve –roughly 82 MMbbls (13%) at current prices.

Infrastructure bills generally have a bullish impact on fuel prices. Paving roads and building bridges require significant fuel consumption for companies like concrete producers and construction companies. It also makes public roads more traversable, making it easier for drivers to hit the road. Typically, infrastructure bills come with an associated increase in fuel taxes, though this bill will not increase the federal fuel tax.

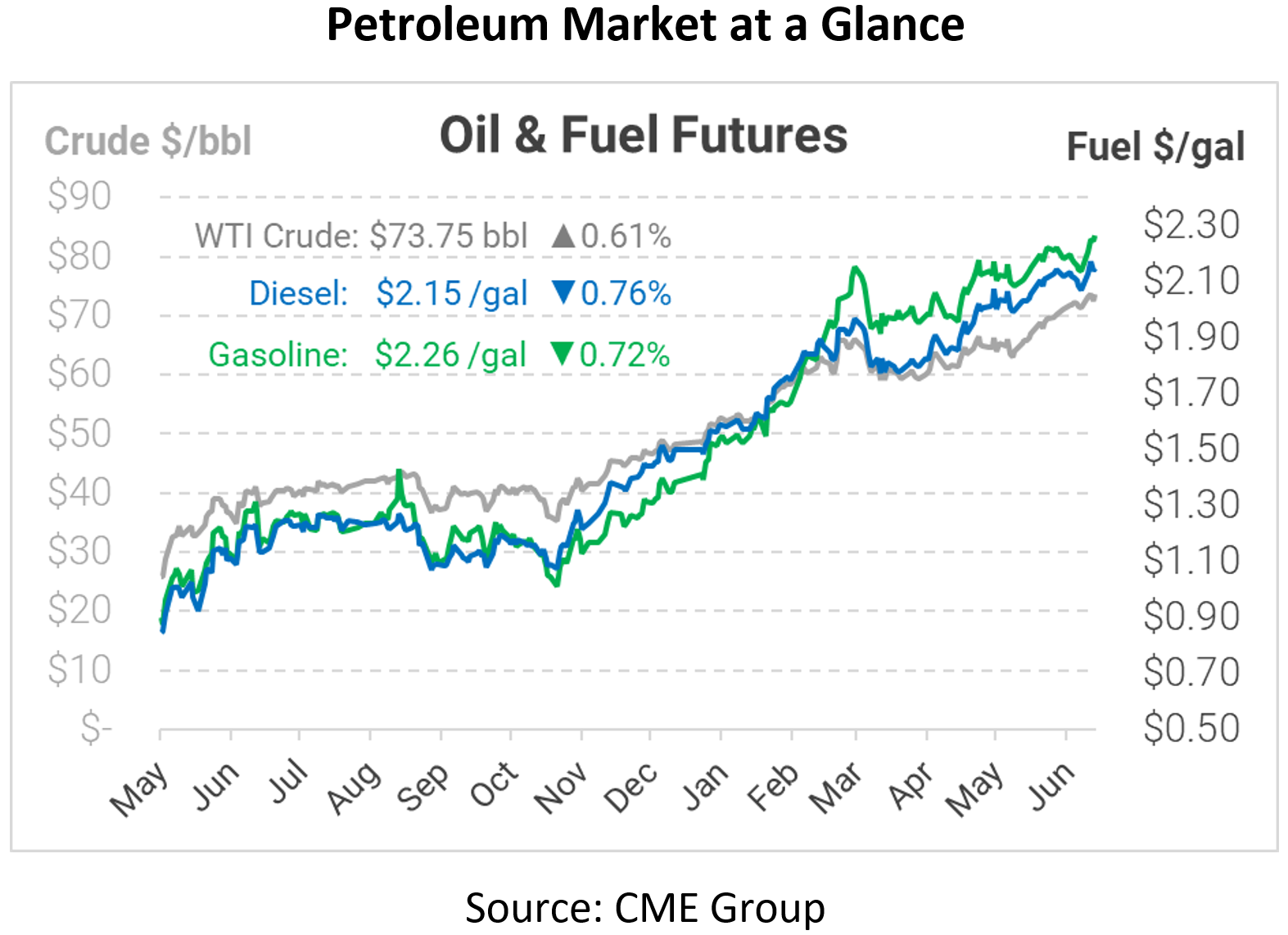

Rising oil prices have been making headlines recently, but refined product markets are showing particular exuberance. Gasoline prices are on the cusp of $2.30 – a price not seen since October 2014. Diesel prices are also at their highest level since 2018. Post-pandemic fuel markets are quickly growing tighter, and there doesn’t seem to be a clear end in sight. A declining US dollar is also contributing to higher oil prices, providing tailwinds to the rally across financial markets.

In biofuels news, the US Supreme Court issued a decision supporting small refineries, who had requested exemptions from biofuel obligations due to economic hardship. A lower court had ruled the EPA could not grant such waivers, but the Supreme Court overturned the decision. The ruling is bad for biofuel producers, since it means fewer refineries will need to purchase RINs, weakening demand and causing lower RINs prices. Biofuel producers receive RINs by producing and blending biofuels with petroleum-based products, so they prefer higher RINs prices.

This article is part of Daily Market News & Insights

Tagged: Biden, infrastructure bill, supreme court

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.