US Extends Chevron Waivers in Venezuela

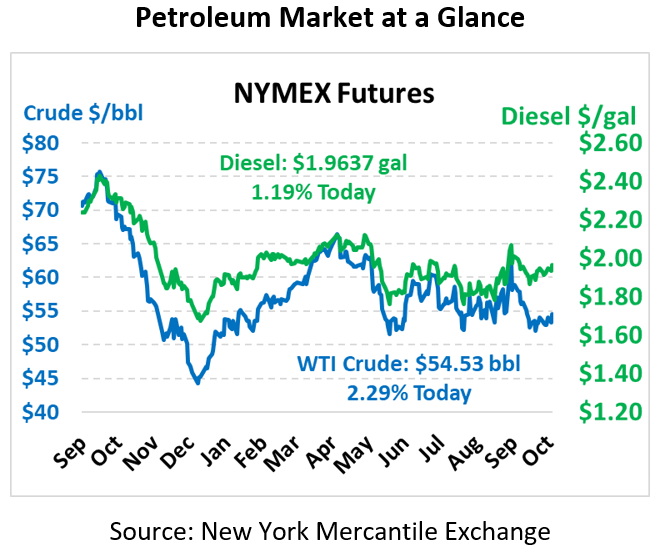

Yesterday brought yet another day closing within a dollar of $53/bbl, the fourth consecutive close in this range. Thought markets dipped lower yesterday, they are rising once again today. Crude oil is currently trading at $54.53, a gain of $1.22.

Fuel is also trading higher this morning. Diesel is trading at $1.9637, up 2.3 cents. Gasoline is trading at $1.6333, a gain of 2.6 cents.

US-China trade continues influencing market direction. Today, positive comments from China are lifting prices once again, though so far this year trade has had mixed impacts on prices. Until an agreement is signed and done, though, expect any trade rumors to have transient impacts on the market.

The US extended Chevron’s waiver allowing it to continue working in Venezuela, which allows Venezuelan crude production to continue at current levels. Sanctions have caused Venezuelan output to crater, but Chevron still maintains roughly 200 kbpd of crude production, a quarter of the country’s total output. The waiver extends Chevron’s production for three months (through January 22, 2020) – hardly long enough to create market confidence in continued production. If waivers are ended in January, prices could rise as production falls.

This article is part of Crude

Tagged: Chevron, US, US-China trade, Venezuela

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.