US-China Trade Talks Resume

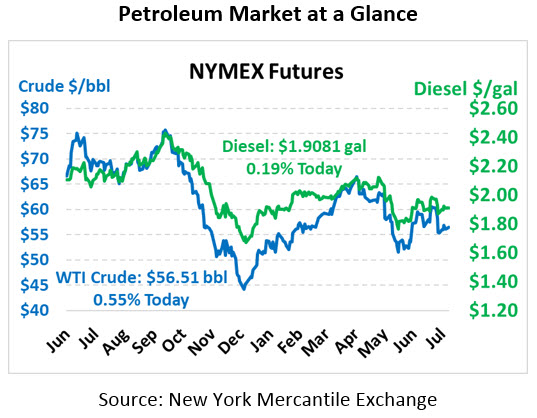

Oil prices saw little change last week despite significant ups and downs in trading activity. This morning crude oil remains relatively flat, up just 31 cents to trade at $65.51.

Fuel prices are mixed this morning, with diesel tracking crude oil while gasoline dips lower. Diesel prices are currently trading at $1.9081, up 0.4 cents from Friday’s close. Gasoline prices are trading at $1.8620, a 1.2 cent drop.

Markets are focusing heavily on US-China trade talks, which will resume tomorrow in Shanghai. Trump hinted last week that China may delay any deal until after the 2020 election. Both sides have reason to prolong negotiations. China is hoping that November will bring a more trade-friendly administration, while Trump hopes to use on-going negotiations as a campaign topic heading into presidential debates. The latest round of negotiations will merely level the playing field once again, with China resuming purchases of US agriculture and America taking further tariffs off the table for now.

Baker Hughes reported yet another decline in US rig counts, which demonstrates producers being pickier over which wells they choose to tap. As rig counts have fallen, output per rig had generally risen, allowing overall production rates to remain steady. As US production rises, many have asked whether the growth is sustainable. Current projections for US output show production rising above 13 MMbpd in 2020.

With oil prices fluctuating, US producers must be more careful to spend wisely. Halliburton, a leading oil field services company, announced last week that it would be cutting 8% of its labor force as producers cut back their activity. Later this week, the oil majors will be reporting their Q2 earnings, which will provide some insight into how the current oil price climate is affecting their bottom-line results.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.