US-China Tensions Flare as World Returns to Normal

While oil markets are closely monitoring the return to normalcy for demand, equity markets are turning their attention to US-China tensions, which have continued escalating in recent days. Ths US has been ramping up its military presence in the Indo-Pacific region, conducting training exercises throughout the region and issuing provocative statements of America’s ability to exert force during the pandemic. The US Commerce Department recently began targeting semiconductor supplies to Chinese 5G-manufacturer Huawei, and the agency has long pushed allies to abandon Huawei over risks of Chinese spying.

Citi yesterday issued a report declaring that dismal demand projections were mostly over-hyped and that Q2 demand destruction will be just 15.7 MMbpd. Given the relatively small drop, OPEC’s cuts should bring the market into balance sooner rather than later, allowing WTI crude prices to bounce back to $42/bbl by Q4. Notably, the group believes that shale producers, though suffering now, will be able to spring back into action once crude prices rise above $40 later this year. Of course, market recovery is subject to increased supply risk from any number of production countries, including the US, Canada, Norway, OPEC+, and more. Still, the shift from demand-focused forecasts to supply-focused forecasts suggests markets have normalized enough that OPEC+ and other producers finally have some influence over prices again.

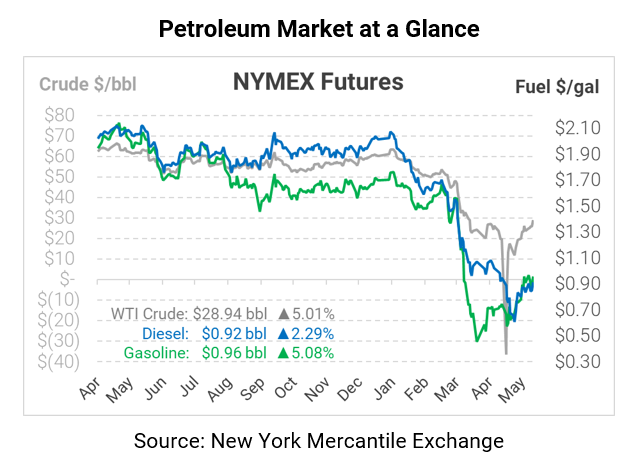

Crude oil is moving sharply higher this morning on improving trade psychology. Most traders seem to be taking the approach that no critically bad news is good news. Although COVID-19 deaths continue rising, the curve has been flattened sufficiently to enable reopening – a win for the economy. WTI crude is currently trading at $28.94, a gain of $1.38/bbl (+5.0%).

Fuel prices are also moving higher, though diesel is lagging the broader market. Gasoline prices are trading at $0.9610, up 4.7 cents (+5.1%). Diesel is trading at $0.9153, a 2.1 cent (+2.3%) gain.

This article is part of Daily Market News & Insights

Tagged: crude, diesel, gasoline, Oil markets, pandemic, US-China tensions

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.