US, China, Others Agree to Strategic Oil Releases

It’s fairly common for politics to influence oil prices, but it’s a bit less often that oil prices so directly effect politics. We’ve written extensively lately about the impact that high oil prices are having on the Biden administration and what (limited) control the US government has over fuel costs. With that said, the federal government seems to be pulling out all the stops.

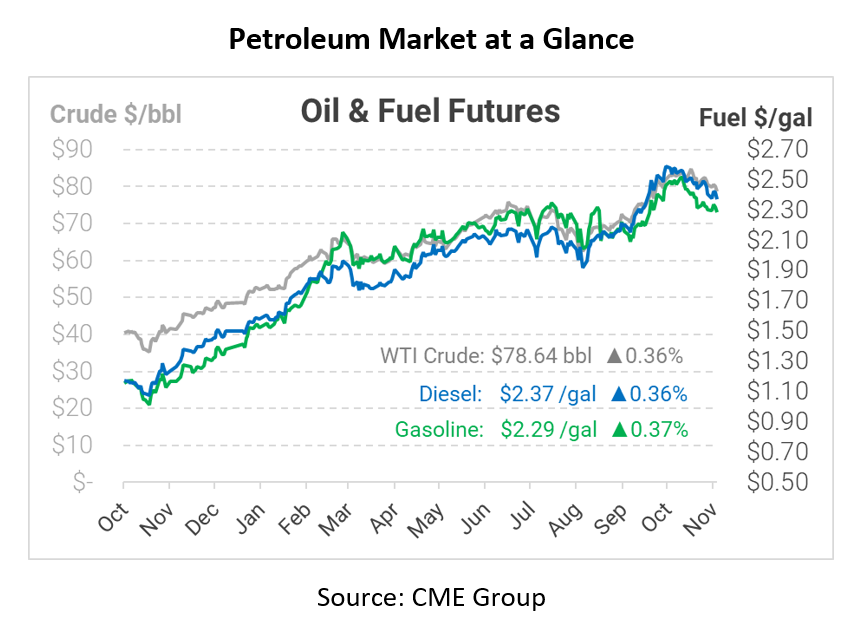

Although the US Strategic Petroleum Reserve cannot single-handedly effect change, it can when combined with the strategic reserves of other countries. President Biden has called on other major economies to begin releasing their oil, and some are agreeing. Markets sank yesterday after China announced plans to release oil from their strategic reserves. For the past few years, Chinese imports to fill reserves have kept prices afloat; now those reserves can be used to help moderate prices globally. The US has already been drawing down reserves, selling 10 million gallons over the past month and bringing reserves to their lowest level since 2003.

In addition to adding supply, President Biden asked the Federal Trade Commission (FTC) to investigate “illegal conduct” among oil majors to push prices higher. In his letter, Biden noted a gap between falling wholesale gasoline prices and retail prices. This phenomenon, which we’ve referred to before as “sticky pump,” is actually quite common, and generally corrects itself within a few weeks. The administration requested a similar investigation in August, which found no wrong-doing.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.