US Asks India to Limit Venezuelan Oil Imports

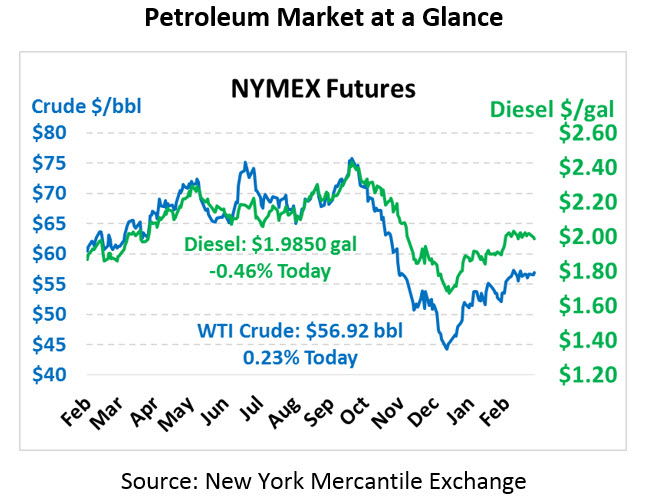

Markets once again peaked near multi-year highs this morning before retreating a bit. Prices have been trapped in a holding pattern between $55-$57 for the past few weeks, with neither the bulls nor the bears able to break through decisively. This afternoon, crude oil is trading at $56.92, gaining 13 cents after yesterday’s 70 cent rally.

Fuel prices are struggling to keep pace with crude oil, posting modest losses today. Diesel is currently trading at $1.9850, down 0.9 cents since Monday’s close. Gasoline prices are trading at $1.8164, down a penny.

All eyes were on Saudi Arabia yesterday as the kingdom announced plans to further cut exports and lift oil prices. Oil rose to the highest level this month on the news. Adding to the momentum was news that Secretary of State Mike Pompeo is engaging with India to limit their purchases of Venezuelan crude. India currently is one of the largest cash purchasers of Venezuelan crude (since exports to China simply offset Venezuelan debt), so this would be a huge blow to Venezuela. At the same time, the move would force India to find other suppliers, tightening global crude supplies.

This week the oil and gas industry is gathered in Houston for CERAWeek, a gathering of prominent industry leaders ranging from Secretary of State Michael Pompeo to Saudi Aramco officials. Among the notable takeaways, International Energy Agency’s executive director Fatih Birol predicted that Enhanced Oil Recovery would add over 3 MMbpd to global production by 2030. When a conventional oil well is taken offline, US DOE data suggests 75% of the oil remains in the ground. Enhanced Oil Recovery would allow some of that additional oil to be extracted – yielding more output than Brazil, Venezuela, or Mexico produce annually.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.