Up and Down – Libya Spurs Rebound after Monday Selloff

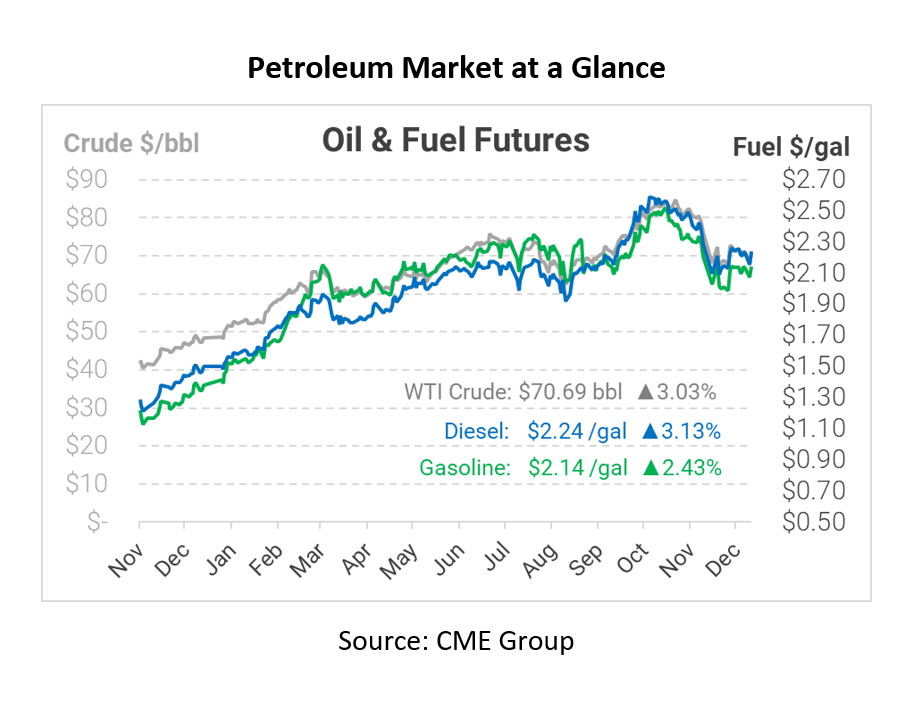

What goes down must come up. Oil prices are springing back as traders buy yesterday’s dip. After shedding $2.60 yesterday, crude oil is up by roughly $1.75 this morning. Fuel prices are actually higher than they were on Wednesday, demonstrating a bullish sentiment for traders this morning.

Beyond COVID challenges, markets are gaining steam due to instability in North Africa. Libya, a country that has been plagued with geopolitical uncertainty, is once again facing an oil production outage. Roughly 300 kbpd, or 0.3% of global supply, has been taken offline by militias, including Libya’s large Sharara field. Libya’s National Oil Company was forced to declare force majeure, with no clear timeline for improvement. The outage is a salient reminder that, even with inventories beginning to improve globally, surprise events can cause prices to rise quickly.

Beyond the outage, prices have been on a seesaw lately. On one hand, Omicron is spreading like wildfire, going from 3% of US cases to 73%. After two years of COVID, markets are very sensitive to rising case rates, since they correlate with travel restrictions and reduced fuel demand. Conversely, Omicron does seem to be less deadly than other variants, meaning there’s reduced risk. On the supply front, OPEC+ was 117% compliant with their cuts in November, meaning member countries produced even less crude than they had planned.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.