U.S. Drilling Output Could Increase Despite Constraints

Today oil prices are down slightly as optimism over possible drilling output increases pairs with damped demand forecast from the International Energy Agency. New forecasts for U.S. production show that there could be some positive momentum despite labor shortages and continued supply chain issues.

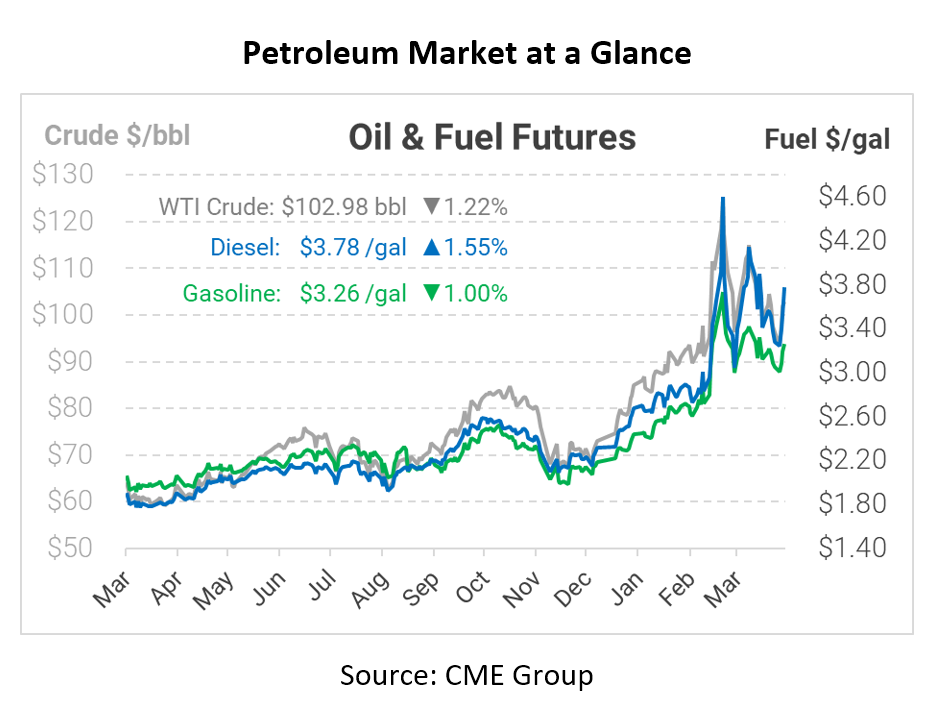

Today, we are sitting at over $100/bbl and a 70% year-over-year increase. This seems like it is becoming the new “norm.” In response, US drillers are beginning to leave the sidelines and show up to produce more oil. According to organizations that track energy supplies in the U.S., the expected output for this year will be up 1.29 million barrels per day. Compared to this same outlook in December, that represents a 300,000 bpd increase, or 23%. This forecast sees the majority of new output coming from the Permian Basin, accounting for 1.13 MMbpd. Production is up all over the country, and specifically, the Permian last week had 332 active oil rigs drilling, which was the most since April 2020.

For U.S. drilling, the outlook is improving. As many have said before, the best cure for high prices is high prices. Oil prices are responding to high prices by increasing output, though the pace of growth is still lagging previous oil rallies. The industry is full of diverse players, from large oil majors down to independent oil and gas drillers, who are all pitching in to overcome supply chain challenges While the future is always uncertain, U.S. drilling could be one success story that helps bring balance to global oil markets.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.