U.S. Commercial Crude Stockpiles Rise while the SPR Level Falls.

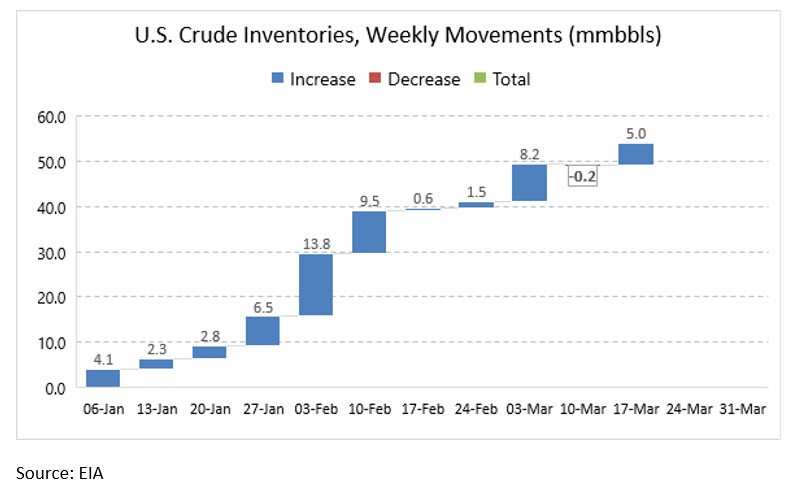

U.S. crude inventories rose once again during the week ended March 17th, 2017, rising by 4.954 mmbbls. As the figure below illustrates, crude inventories have risen in ten of the eleven weeks thus far this year. Last week’s stock draw was a mere 0.2 mmbbls, however, and it had little impact on the total inventory. In the eleven weeks so far this quarter, 54.1 mmbbls of crude have been added to an already-massive inventory, bringing the total to 533.1 mmbbls. This oversupply exerts steady pressure on crude prices. As the commercial stockpile has grown, however, the public stockpile is starting to be drawn down.

The official government stockpile is the Strategic Petroleum Reserve (SPR.) These federally-owned crudes are stored in underground salt caverns at four sites in Texas and Louisiana. The amount of crude in the SPR has been stable at approximately 695 mmbbls since mid-2015. Under Section 5010 of the 21st Century Cures Act, signed on December 13, 2016, the U.S. Secretary of Energy is directed to draw down and sell 25 mmbbls of SPR crude oil during 2017, 2018 and 2019. The sales revenues will be deposited in the general fund of the U.S. Treasury to carry out the National Institutes of Health innovation projects as designed in the 21st Century Cures Act.

SPR crude sales in fiscal year 2017 are to be 10 mmbbls of sour crude from three sites: 3 mmbbls from the Bryan Mound site in Texas, 2.1 mmbbls from the Big Hill site in Texas, and 4.9 mmbbls from the West Hackberry site in Louisiana. The U.S. Department of Energy (USDOE) announced on March 10th that seventeen companies had responded to the notice of sale, and that contracts had been awarded to:

- Atlantic Trading and Marketing, Inc.

- BP Oil Supply

- Marathon Petroleum Company

- PetroChina International (America), Inc.

- Phillips 66

- Shell Trading (U.S.) Company

- Valero Marketing and Supply Company

The deliveries are to take place in May and June, with some early deliveries possible in April. As the following figure shows, SPR crudes already are being reclassified for the upcoming sale. The SPR level dropped by approximately 0.25 mmbbls in the week ended March 3rd, 0.82 mmbbls in the week ended March 10th, and 0.63 mmbbls in the week ended March 17th.

The timing of the SPR sale may seem odd, given how intractable the oversupply has been. Yet the volume of crude in the SPR is well above what is required by law, and the sale is mandated by law. The SPR crudes represent a vast outlay of taxpayer money that, from time to time, may be shifted to another public need. In terms of market impact, if we assume that the 10 mmbbls are delivered in May and June, the additional supply averages out to around 167 kbpd over sixty days. This is a significant volume of supply. It is possible that local market impacts will be mitigated because the purchasers are spread out, and some of the supply will supplant foreign imports. Nonetheless, it will be an injection of 10 mmbbls into what is likely to be a still-oversupplied market at the end of the second quarter, coinciding with the planned expiry of the OPEC production cuts.

This article is part of Crude

Tagged: commercial, crude, SPR level, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.