Two Different Views of the Oil Market

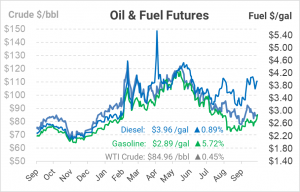

Depending on where you live in the world, you might have one of two radically different views of oil markets. Yesterday, the Executive Director of the International Energy Agency, Fatih Birol, warned that the world may be facing the “first truly global energy crisis.” He added that recent OPEC supply cuts are “especially risky” given the fragility of the global economy. From this perspective, the lack of supply – driven by post-pandemic supply/demand challenges, OPEC cuts, and embargos on Russia – is a severe risk for global markets.

On the other hand, Saudi Arabia’s energy minister Prince Abdulaziz bin Salman sees a very different perspective, one which permeates among OPEC+ members. That group sees energy demand teetering lower as the economy rushes toward a recession. They believe that cuts are necessary to keep markets in balance; without them, energy prices could plummet to levels not seen since the pandemic. After a decade of underinvestment in oil production, another industry rout would cause long-term supply concerns, so better to have a bit of pain now versus even more chronic under-production in the future.

Which view is right? Well, it largely depends on whether you’re a producer or a consumer. Knowing that oil production will be profitable for the next few years is a real benefit for oil producers, incentivizing investment in long-term projects. Those projects will eventually be beneficial for consumers, but not for 3-5 years – which can feel like practically never. On the consumer end, crushing inflation and a weak economic outlook make it seem obvious that now is not the time to tamper with prices. It’s all a matter of perspective.

This article is part of Daily Market News & Insights

Tagged: energy crisis, IEA, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.