What Trump’s Tariffs Mean for Fleets

Market outlook

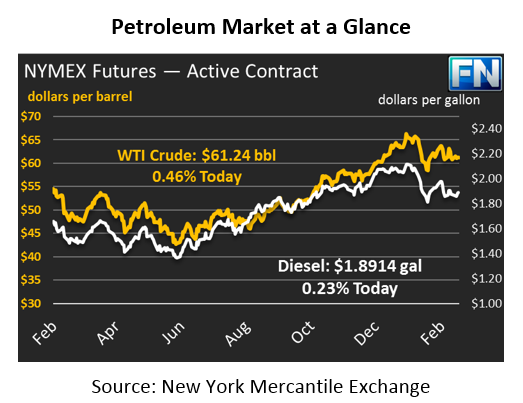

Oil prices saw a relatively small decline on Friday, following a week that brought steep losses for crude oil and fuels. Crude ended the week roughly $2/bbl lower, while Brent crude fell nearly $3/bbl. Today, crude oil prices are trading flat, changing just 7 cents and trading at $61.32.

Fuels are in more negative territory this morning. Despite a small gain in gasoline prices on Friday, both gasoline and diesel are trading roughly a penny lower today. Diesel prices are currently $1.8701, while gasoline prices are $1.8919.

CFTC data shows Managed Money funds edged up their net length in WTI crude, a reversal from the three-week downward trend in net speculative lengths. Comparing WTI prices to net length, the green line below shows crude prices rising over the last week, creating incentive for managed funds to raise their net length (blue bars) to capitalize on rising prices. Net length remains near record highs, but has pulled back slightly from early-2018 peaks, giving the market more room to rise if fundamentals shift and create strong upward momentum.

Trump’s Tariffs – What It Means for Fleets

Markets continue to analyze the expected impact of Trump’s heavy tariffs on steel and aluminum. Tariffs are taxes imposed only on imports. While the President contends the tariffs will help domestic producers, economists warn against protectionism and its resulting harm to trade flows. If China or other countries respond to the tariffs by announcing their own tariffs, American exports would be harmed. European partners have threatened to impose sanctions on U.S. staple products, but Trump threatened them by hinting at tariffs on European vehicles.

Tariffs are good for domestic producers, because they raise the price of foreign competition and make it easier for local producers to raise their prices. However, tariffs hurt consumers. Already, food and beverage companies have protested the tariffs, saying aluminum sheets hold no national security implications but are crucial for canning beverages and other applications. Vehicle manufacturers agree that tariffs would raise vehicle production costs, ultimately requiring costs be passed on to consumers.

Why does this affect oil markets? Tariffs slow the flow of international goods, directly reducing maritime shipping demand. In addition, tariffs reduce economic activity by removing spare income from the economy, leaving consumers less money to use on driving and transportation. Strong demand has been a driver for the high prices recently, so one hidden benefit of the tariffs may be lower oil prices. Of course, if the trucks and engine components using the fuel become more expensive as manufacturers have warned, the net result could be higher costs for fleets.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.