Trump States US-China Trade Deal “Fully Intact”

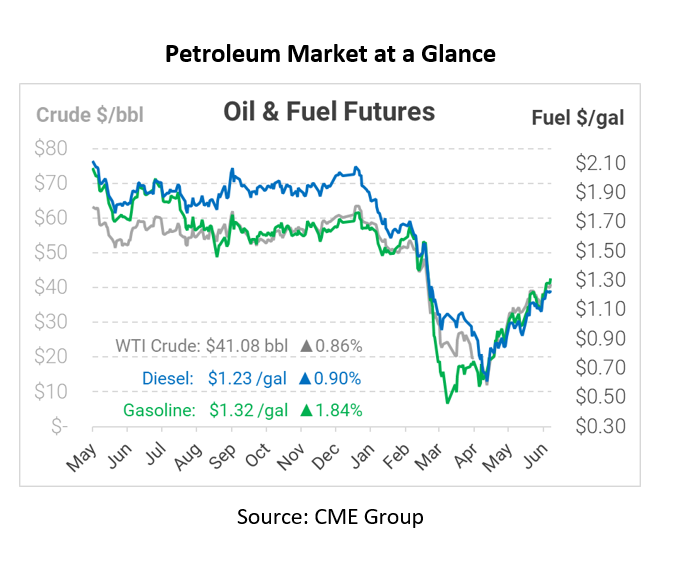

Yesterday, WTI crude was up 2% on tighter crude supplies from major producers. In addition, coronavirus lockdowns kept easing despite a record rise in cases globally. WTI settled at $40.73/bbl, rising 90 cents (2.2%). Crude prices are up in early trading this morning as White House officials clarified a previously confusing statement saying that the US-China trade deal was in place.

Earlier on Monday, when asked about the trade agreement, White House trade adviser Peter Navarro told Fox News, “it’s over.” The adviser’s comments injected volatility into global markets with currency and futures markets dropping and Asian markets going into negative territory before recovering after Navarro issued a statement that his comments had “been taken wildly out of context.” A trade deal worth $200 billion between China and the United States is “fully intact,” President Donald Trump said Monday night, just hours after his senior trade adviser rattled markets. Asian equities bounced back after President Trump’s announcement, clarifying earlier confusing statements from the White House over the fate of the deal.

In early trading today, crude prices are up. Crude is currently trading at $41.08, a gain of 35 cents.

Fuel prices are up this morning. Diesel is trading at $1.2296, a gain of 1.1 cents. Gasoline is trading at $1.3150, an increase of 2.4 cents.

This article is part of Daily Market News & Insights

Tagged: China, trade deal, Trump

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.