Trump Opens ANWR Production – But It’s Not the Boon Many Expect

Yesterday, WTI crude closed higher as it followed US equities to end with small gains on the day. The Trump administration released plans to allow drilling in the Arctic National Wildlife Refuge (ANWR), a contentious area which has long been the source of debate between oil lobbyists and environmentalists. Although ANWR was opened up to oil leasing back in 2017, lease sales have been slow. The latest update will open up 1.5 million acres along the coastal plain.

Although the topic is a hot button politically, the announcement will have little effect on oil prices in the short- to medium-term. Very little oil exploration has occurred in the Arctic, meaning that oil companies will first have to search for oil, then begin the long process of drilling in a inhospitable climate, and finally complete infrastructure to carry the oil from reserves to major markets. And all that assumes no major litigation against drillers. Reuters quoted Interior Department Secretary as saying it would take eight years to begin oil production after oil is found. Two years ago, the EIA estimated that oil drilling would not be feasible until at least 2031, adding that peak production of 880 kbpd (roughly 6% of America’s pre-COVID output) would come in 2041.

News of tankers being commissioned for the next few months to bring crude from the US to China helped to lift markets. Although China is far behind its Phase One trade deal quota, the market interpreted the orders as a positive sign that US-China relations are not as frayed as they had seemed and that China is trying to comply with the trade deal. So far, the Trump regime has been quiet on China’s lack of compliance in light of the economic havoc caused by the pandemic.

Also buoying markets is news from OPEC+ of high compliance rates with production cuts. OPEC+ announced that it had reached 96% compliance in July with supply cuts. OPEC+ had relaxed its cuts last month to 7.7 MMbpd from previous cut level of 9.7 MMbpd. Price gains in the market have been capped by demand fears as both OPEC and the IEA lowered their demand forecasts this month. OPEC+ will meet this week to discuss whether or not current cuts are sufficient to balance the market or if further action is necessary.

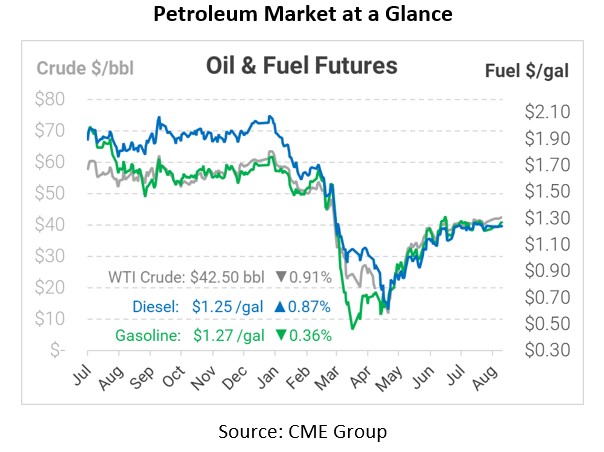

In early trading today, crude prices are down. Crude is currently trading at $42.50, a loss of 39 cents.

Fuel prices are mixed this morning. Diesel is trading at $1.2499, a gain of 1.1 cents. Gasoline is trading at $1.2654, a loss of 0.5 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.