Traders Keep an Eye on Washington for Clues

Crude rose slightly on Monday, following US equities higher. Concern over rising coronavirus cases in the US and Europe continue to put a cap on prices. More than one million people have died of the coronavirus during this pandemic, which has ravaged economies around the world and affected fuel demand. While prices have broken the $40 level over the past few trading days, they have been unable to break out further. Crude is trading lower in early trading this morning, but still near the $40 threshold.

Traders are cautious ahead of the first US presidential debate to be held tomorrow. The first debate will help set the tone for the election, which will have important implications on the future of the economy, energy, and environmental issues. In particular, markets are looking at the stimulus measures either party might take to counteract the sluggish economy. Moody’s Analytics reports on several scenarios, noting that larger fiscal stimulus commitments are associated with a broader rebound for the US economy.

Crude prices are also being supported by talks of a Democratic stimulus bill in the House. House of Representatives Speaker Nancy Pelosi, and Democratic lawmakers unveiled a new compromise bill for $2.2 trillion in stimulus relief in the hopes of getting it passed before the election. While both sides of the aisle agree a stimulus package is needed, they have been unable to agree on how much to spend on a plan.

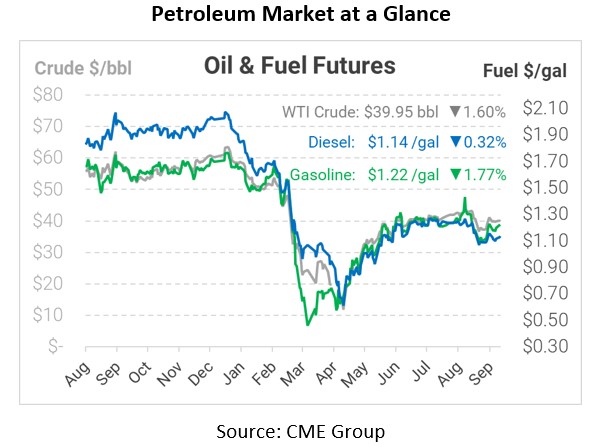

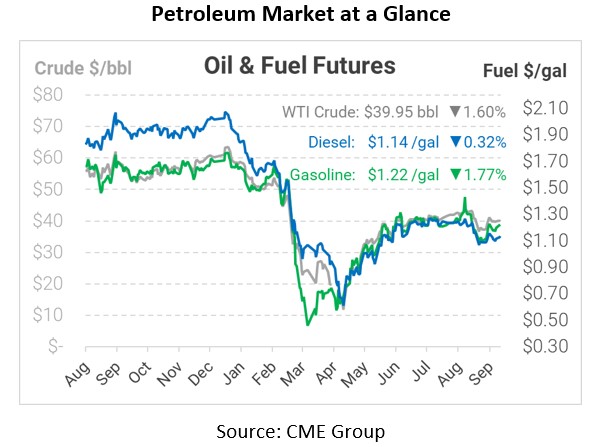

In early trading today, crude prices are down. Crude is currently trading at $39.95, a loss of 65 cents.

Fuel prices are down this morning. Diesel is trading at $1.1359, a loss of 0.4 cents. Gasoline is trading at $1.2245, a loss of 2.2 cents.

This article is part of Daily Market News & Insights

Tagged: coronavirus, debate, election, Stimulus

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.