Trade Wars Fear – Have We Reached the Bottom Yet?

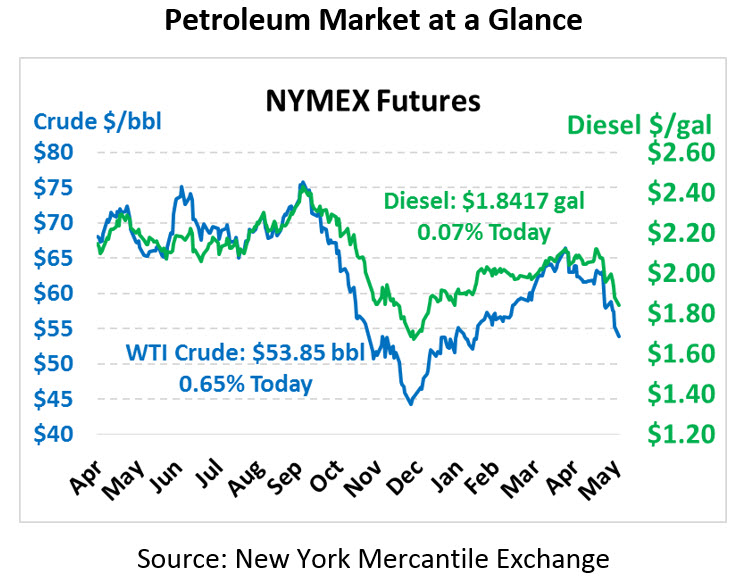

The crude market is trading up this morning following last week’s dramatic decline. Crude this morning is trading at $53.85, up from Friday’s close by 35 cents.

Fuel prices are relatively flat. Gasoline is currently trading for $1.7696, down fractionally. Diesel prices are $1.8417, up fractionally.

The continued escalation of the trade war with China already had the markets in decline, but with added fear from proposed tariffs on Mexican goods, Trump instigated a route in oil last week. The U.S. and Mexican economies are intertwined and tariffs on Mexican goods, including oil, would be acutely felt by American consumers. Fears of a global economic slowdown and decreasing oil demand led the selloff that we saw last week, but early trading on Monday seem to indicate a bottom might have been reached.

Increases we are seeing this morning come on the heels of news from Saudi Arabia signaling that OPEC and its allies would likely keep production cuts in place beyond June to stabilize supplies and prices. OPEC+ had agreed to production cuts to help oil recover from December lows. We have seen a lot of those gains from the past few months given back in the last few weeks. In addition to OPEC moves, a possible strike in the Norwegian oil industry helped to buoy prices today with the prospect of possible production outages related to the strike.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.