Today’s Market Trend

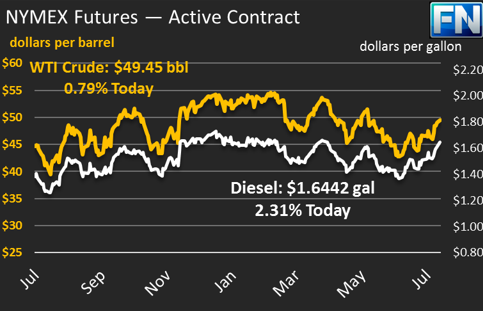

Crude prices are down this morning to $49.45/bbl, after briefly surpassing $50/bbl in early morning trading. Prices are off .26 (.5%) from Friday’s close. Prices closed the day Friday at $49.71, a gain of $.54 (1.1%) from the opening price. Prices have been on shaky ground this morning, awaiting clearer news on Venezuela.

For refined products, prices are actually higher this morning than their Friday close. Diesel has gained $.0045 (.27%) to reach $1.6642, and gasoline gained a full $.0125 amid high volume trading on Friday to reach $1.6885 this morning.

OPEC announced over the weekend that members would be meeting next week, Aug 7-8, to discuss deal compliance. Markets expect the meeting to be a non-event for prices, since OPEC compliance has been relatively high, and non-compliant members will likely just pay lip-service to the cuts.

Rig counts showed positive growth in Friday’s report, adding 2 rigs for the week. Rig count growth has slowed significantly, with rigs growing by just 10 in July, the least impressive growth since May 2016. Goldman Sachs reports that rig counts should trend positively as long as prices remain above $45.

Despite the slow-down in production trends, net trading positions have added more length this week, with the CFTC reporting a gain in speculative long positions. Markets are growing more and more bullish about the outlook of the market; analysts are “cautiously optimistic” about oil price growth for the second half of 2017.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.