Today’s Market Trend

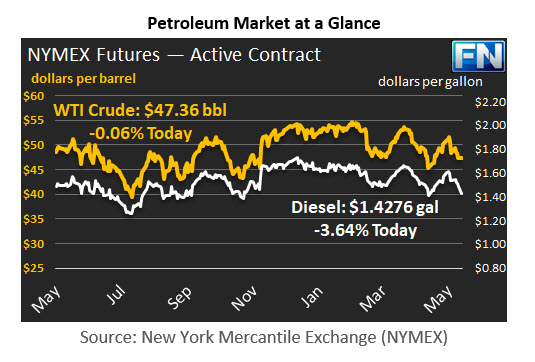

WTI crude prices are in the $47.25-$47.50/b range this morning. Prices sagged for most of Friday before beginning to recover and closing at $47.66. WTI prices during the four-day week ended $2.27 in the red. WTI opened at $47.71/b today, a decline of $0.33, or 0.69%, below Friday’s opening price. Current prices are $47.36/b, a decrease of $0.30 below Friday’s closing price.

Diesel opened at $1.4835/gallon this morning. This was a drop of 1.66 cents (1.11%) below Friday’s opening price. Current prices are $1.4726/gallon, down by 1.22 cents from Friday’s closing price.

Gasoline opened at $1.577/gallon today, a drop of 1.51 cents, or 0.95%, from Friday’s opening. Prices are $1.5664/gallon currently, a drop of 1.07 cents from Friday’s close.

Early this morning, crude prices surged briefly when Saudi Arabia, Bahrain, the UAE, and Egypt cut off diplomatic ties with Qatar. Bloomberg reported that the rift was caused mainly by Qatar’s increasing tolerance toward Iran and certain radical Islamist groups. Geopolitical uncertainty caused WTI prices to rise as high as $48.42/b and Brent prices to rise to $50.73/b. Prices subsided when Qatari officials spoke out to de-escalate tensions, and other parties appeared willing to open talks to resolve the matter.

The price spike occurred in between market openings. Crude, gasoline, and diesel futures prices have opened lower for the past four sessions. Last week, prices weakened despite a solid set of weekly supply data from the Energy Information Administration (EIA.)

Supplies also remain more than ample, however, both in the U.S. and abroad. Libyan production reportedly hit 800 kbpd, and its National Oil Company (NOC) is planning to ramp up to 1100 kbpd in August. Nigeria’s production rose to 1500 kbpd with the resumption of production from the Forcados field.

In the U.S., crude production rose by 22 kbpd, reaching an average of 9342 kbpd during the week ended May 26th. This was the highest level in twenty-one months. Baker Hughes reported that the active oil and gas rig count increased by eight last week, bringing the total to 916. This was the highest rig count since April 2015, twenty-five months ago.

The U.S. Bureau of Labor Statistics (BLS) released the Jobs Report for May. Total non-farm employment increased by 138,000 in May. This missed the expectation of 182,000 jobs. Unemployment declined to 4.3%. Since January, the unemployment rate has dropped by 0.5 percent. The number of the unemployed has decreased by 774,000. The Index of Consumer Sentiment calculated by the University of Michigan rose to 97.1 in May, up slightly from 97.0 in April.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.