Today’s Market Trend

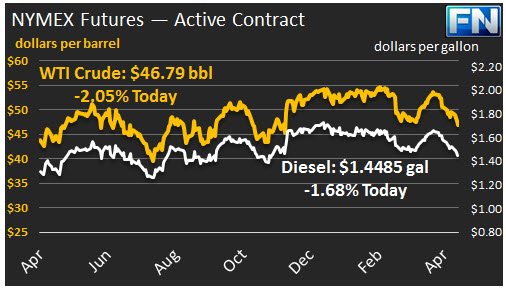

WTI crude prices have spiraled below $47/b range this morning. Prices yesterday trended generally down, closing at $47.82/b. WTI opened at $47.60/b today, a drop of $0.52, or 1.08%, below yesterday’s opening price. Current prices are $46.79/b, a hefty drop of $1.03 below yesterday’s closing price. Prices at the moment are as low as they were in late-November, just prior to OPEC making its historic production cut deal. WTI crude prices have opened lower in eleven of the last fifteen trading sessions, falling by 10.9% ($5.80/b) since April 12th. Product prices also weakened yesterday, and they have followed crude down in early morning trading today.

Diesel opened at $1.4691/gallon in today’s trading session. This was a drop of 1.92 cents (1.29%) below yesterday’s opening price. Current prices are $1.4485/gallon, down 2.51 cents from yesterday’s closing price. Diesel prices have opened lower for thirteen of the last fifteen trading sessions, dropping by 18.54 cents, or 11.2%, since April 12th.

Gasoline opened at $1.5264/gallon today, down 1.23 cents, or 0.80%, from yesterday’s opening. Prices are $1.50/gallon currently, a sharp drop of 3.38 cents from yesterday’s close. Gasoline prices have opened lower in fourteen of the last fifteen trading sessions, dropping by a total of 23.75 cents, or 13.5%, since April 12th.

The EIA released its weekly supply data yesterday, showing a 0.93-mmbbl drawdown in crude stocks and a 0.562-mmbbl drawdown in diesel stocks. However, gasoline inventories grew by 0.191 mmbbls. This result was far more bearish than forecast by the API, which had reported across-the-board declines in inventories: 4.2 mmbbls of crude, 0.4-mmbbls of gasoline, and 1.9 mmbbls of diesel.

The EIA data also showed another increase in U.S. crude production of 28 kbpd for the week ended April 28th, bringing crude production to 9293 kbpd. This was 347 kbpd higher than it was during the first week of January, 2017. Apparent demand for jet fuel and diesel rose significantly during the week, but apparent demand for gasoline decreased again, falling to 9156 kbpd. Although we have noted that the weekly demand figures are not considered as accurate as the monthly data later published (with a two-month time lag,) it is significant that this data series indicates that gasoline demand in April 2017 was approximately 200 kbpd lower than it was in April 2016. Assuming that the data methodology is consistent, gasoline demand is well below its levels of last year.

The issue of gasoline and diesel taxes is emerging on the political scene. President Trump stated that he was open to raising gasoline taxes at the federal level to help pay for infrastructure costs, in sharp contrast to earlier anti-tax promises. California already is working to pass a significant hike in fuel and vehicle taxes. Our second article today discusses the California proposal.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.