Today’s Market Trend

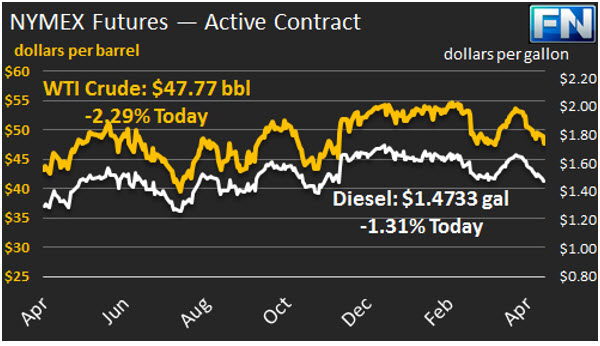

WTI crude prices have fallen below $48/b this morning. A sharp drop in prices yesterday brought the market to a close of $47.66/b, the lowest closing price since March 21st, six weeks ago. WTI opened at $48.12/b today, a drop of $0.66, or 1.35%, below yesterday’s opening price. Current prices are $47.77/b, a recovery of $0.11 above yesterday’s closing price. WTI crude prices have opened lower in ten of the last fourteen trading sessions, falling by 9.9% ($5.28/b) since April 12th. Product prices also plunged yesterday, then showed a small recovery and a plateau in early morning trading today.

Diesel opened at $1.4883/gallon in today’s trading session. This was an increase of 0.22 cents (0.15%) above yesterday’s opening price. Current prices are $1.4733/gallon, up 0.53 cents from yesterday’s closing price. Diesel prices have opened lower for twelve of the last fourteen trading sessions, shedding 16.62 cents, or 10%, since April 12th.

Gasoline opened at $1.5481/gallon today, down 0.72 cents, or 0.46%, from yesterday’s opening. Prices are $1.5319/gallon currently, recouping 1.83 cents from yesterday’s close. Gasoline prices have opened lower in thirteen of the last fourteen trading sessions, dropping by a total of 21.58 cents, or 12.2%, since April 12th.

Prices have been weakening for approximately three weeks, but yesterday’s collapse was swift and steep, and prices broke through some key technical supports. It was the first time in five weeks that WTI crude closed below $48/b. The sharpness of the collapse is being attributed largely to a Reuters survey which concluded that compliance with the OPEC-Non-OPEC production cut agreement slipped to 90% from a revised 92% in March. OPEC reports that its crude production fell each month during the first quarter, and OPEC production reportedly fell again in April, by approximately 40 kbpd. But the Reuters survey indicates that unexpectedly high output from Angola and the UAE caused the compliance rate to slip. This news compounded the news that Libyan production has risen, elevating concerns about oversupply.

The downturn caused by this news appears to have been partly mitigated by the release of information on U.S. oil inventories. The API reportedly noted that crude inventories fell by 4.2 mmbbls, well above the Schneider Electric survey results which indicated a 2.75-mmbbl drawdown. The API data also showed a 0.4-mmbbl gasoline drawdown and a 1.9-mmbbl diesel drawdown during the week ended April 28.

The EIA will release the official weekly supply data later today. The stock movements will be important, but as discussed in earlier issues of FUELSNews, apparent demand numbers will be even more critical. Most forecasts of 2017’s supply and demand balance have been predicated on strong demand in the U.S., and so far, demand has undershot the forecasts.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.