Today’s Market Trend

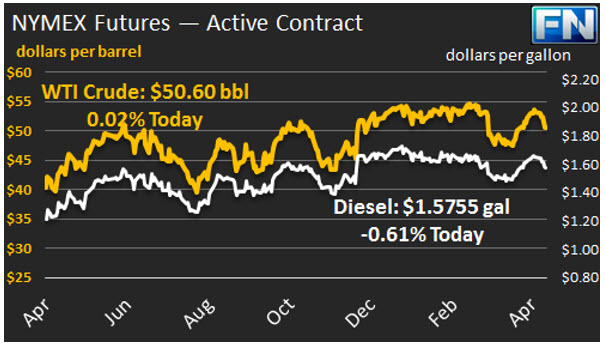

WTI crude prices are in the $50.50-$50.75/b range this morning. Wednesday brought a sharp downward price correction, and prices yesterday stagnated. WTI opened at $50.71/b today, an increase of $0.08, or 0.16%, above yesterday’s opening price. Current prices are $50.60/b, $0.11 below yesterday’s close. Product prices also dropped sharply Wednesday. Like crude, product prices levelled and were flattish Thursday, with gasoline showing more price strength than diesel.

Diesel opened at $1.579/gallon in today’s session. This was a decline of 0.4 cents (0.25%) below yesterday’s opening price. Current prices are $1.5755/gallon, slightly down by 0.034 cents from yesterday’s closing price.

Gasoline opened at $1.6682/gallon today, up 0.63 cents, or 0.38%, from yesterday’s opening. Prices are $1.6724/gallon currently, up slightly by 0.19 cents from yesterday’s close.

Last week, prices had risen partly in response to geopolitical risk stemming from North Korea’s missile test. This week, the market discounted the threat, and price gains began to be reversed. Prices dropped sharply in the hours after the release of the EIA’s weekly supply data, even though the data were not entirely bearish. The crude stock draw should have been supportive of crude prices, for example. But it appeared to be overshadowed by a surprise build in gasoline inventories, But it appeared to be overshadowed by a surprise build in gasoline inventories, plus a drop in demand amounting to 439 kbpd of refined products. This included 52 kbpd of gasoline and 458 kbpd of diesel.”This included 52 kbpd of gasoline and 458 kbpd of diesel. Domestic fuel production increased, with an additional 241 kbpd of crude runs. The softening of the supply-demand balance contributed to the downward price movement, but it was not so dramatic that it was the only factor at work. Goldman Sachs concludes that the selloff was driven by technicals rather than fundamentals. Overall, market prices are back where they were at the beginning of the month.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.