Today’s Market Trend

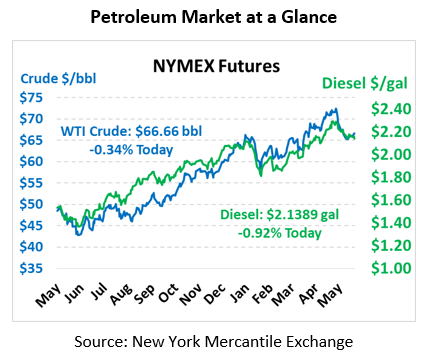

Prices are moving lower this morning as OPEC rhetoric is indicating a production increase to be announced next week in Vienna. Crude oil saw minor gains during yesterday’s session, peaking at $67.16, the highest price since June 1. Today, oil prices are reversing the gains, trading 23 cents lower than yesterday’s closing price, at $66.66.

While crude prices received moderate support yesterday, fuel prices decreased. NYMEX diesel and gasoline prices lost over 2 cents yesterday. Today, diesel prices have continued to fall, moving almost 2 cents lower to $2.1389. Gasoline has dropped over a penny, trading at $2.0732 this morning.

With the June 22 meeting just one week away, the market continues to focus on OPEC news. Yesterday, the Russian Energy Minister stated production could begin to increase July 1 and gradually rise to reach 1.5 MMbpd in additional supply. The Saudi Energy Minister also said a reasonable increase would be “inevitable”. However, Iran’s OPEC governor disagrees, stating the market does not need a production increase; Venezuela and Iraq agree. In other international news, Libya took 240 kbpd offline yesterday as workers evacuated Crude terminal Ras Lanuf and Es sider due to nearby fighting. The National Oil Corporation declared force majeure on loading.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.