Bearish API Report + EIA Market Outlook

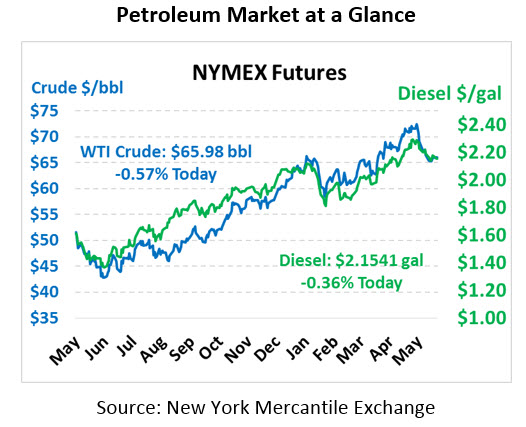

The oil complex trading slightly lower this morning following a bearish API report. Crude made some upward movement during yesterday’s trade, closing the day 35 cents higher despite bearish inventory data. Crude has been unable to maintain those gains this morning as prices have fallen 38 cents to trade at $65.98 currently.

Fuel prices are tracking crude lower this morning. Diesel prices traded mostly flat yesterday, ending the session only 7 points lower. Gasoline saw heavier loses, trading down 1.5 cents. Prices are continuing their decline this morning with diesel trading at $2.1541 and gasoline at $2.0880 currently.

The API reported inventory builds across-the-board this week. Crude built by 0.8 MMbbls contradicting the markets expectation of a 2.7 MMbbls draw. Gasoline and diesel built, aligning with market consensus, but by larger amounts than expected. EIA data will come out shortly to confirm or contradict these estimates.

EIA Short Term Energy Outlook

The EIA released its monthly Short Term Energy Outlook (STEO) yesterday. EIA estimates crude production to average 10.8 MMbpd in 2018 and 11.8 MMbpd in 2019. Net U.S. imports are expected to fall from 3.7 MMbpd in 2017 to 2.5 MMbpd in 2018 and 1.6 MMbpd in 2019, which would be the lowest level since 1959.

For the 2018 April–September summer driving season, EIA forecasts U.S. regular gasoline retail prices to average $2.87/gal, up from an average of $2.41/gal last summer. The higher forecast gasoline prices are primarily the result of higher forecast crude oil prices. Monthly average gasoline prices are expected to reach a summer peak in June of $2.92/gal and are forecast to decline gradually afterwards to $2.84/gal in September. Click here to read the full report.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.