Today’s Market Trend

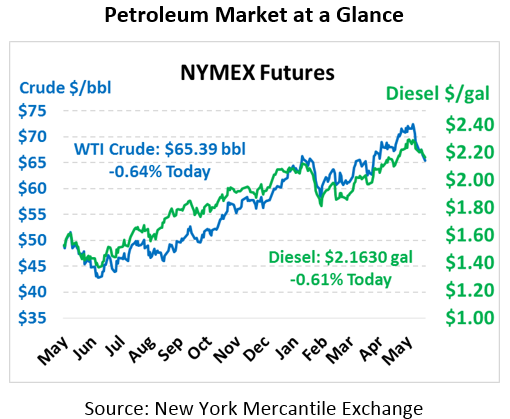

Oil prices continue to dip lower following last week’s decline. Crude closed $1.56 lower on Friday, ending the week in negative territory. Today, crude is currently trading at $65.39, down 42 cents from Friday’s close.

Fuel prices trended lower Friday, with diesel prices giving up 3.4 cents while gas prices fell over 2 cents. Today, both products are continuing their decline from last week. Diesel prices are trading at $2.1630, a loss of 1.3 cents. Gasoline prices have exceeded diesel’s losses, trading at $2.1231, down just over 2 cents.

The Baker Hughes rig count rose by 2 to 861 rigs for the week of June 1. Pipeline constraints, labor shortages and transportation limitations continue to create bottlenecks in Permian Basin. The rig count in this region decreased by 1 last week. Read last week’s FUELSNews article discussing rig counts to learn how constraints in the Permian are impacting prices.

Lack of alternative market moving news has kept the market focused on the June 22 meeting in Vienna where OPEC and non-OPEC members will discuss increasing production. Oil ministers from Saudi Arabia, the UAE, Kuwait, Algeria, and Oman met on Saturday to reiterate the importance of cooperation between producers. The meeting was a non-event as the message was in line with previous discussions.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.