Today’s Market Trend

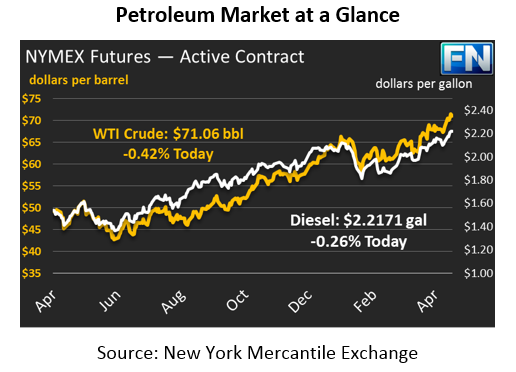

Oil prices have been relatively quiet this morning, following a vivacious week. Crude oil prices ended yesterday marginally in positive territory, but today those gains have reversed. Crude prices are $71.06 currently, down 30 cents.

Fuel prices are also reversing their gains from yesterday. Diesel prices are currently trading at $2.2171, down 0.6 cents since yesterday. Gasoline prices are $2.1847, seeing small losses of 0.4 cents this morning.

Markets are cooling after a heated week, with trading volumes reaching their highest point of the year. Traders rushed in to take part in expected future price increases as Iranian production is taken out of the global market. At the moment, there’s sufficient crude supplies to keep up with demand, but the forecast had been for crude supplies to tighten in the second half of 2018 as summer driving increased consumption. With supplies now expected to constrict, virtually all market participants currently expect prices to rise over the coming months.

In the Middle East, Iranian forces in Syria fired rockets at Israel yesterday, creating an early morning rally yesterday. Statements from the Israeli defense minister helped reduce tensions when he stated, “We have no desires to escalate.” One of the key reasons Trump gave for withdrawing from the Iran nuclear deal was on-going militant activity from Iran – the latest conflict shows that Iran is not backing down from their aggressive foreign policy.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.