Today’s Market Trend

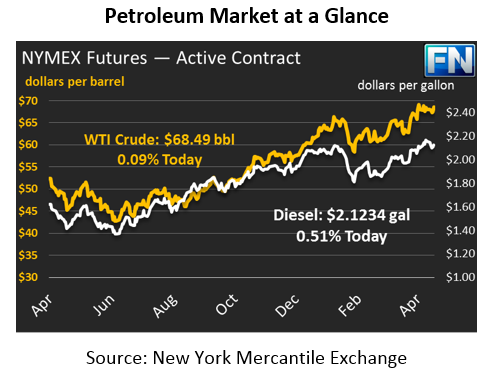

The energy complex is moving higher this morning breaking this week’s pattern of falling during the early morning trade, before recovering later in the afternoon. After a week of trading within 2 week lows, crude is beginning to recover and head back towards $69/bbl. Crude gained 75 cents yesterday, and is holding on to the upward momentum gaining another 6 cents this morning. Though this morning’s prices are mostly flat, crude is remaining in the black at $68.49.

Fuel prices are tracking crude higher, though diesel is outpacing both crude and gasoline on a percentage basis. Diesel traded slightly lower yesterday, but has recovered the minimal losses and gained 1.07 cents this morning to trade at $2.1234. Gasoline closed over 1.50 cents higher on Thursday, and continues to track higher this morning, though at a slightly slower rate. Gasoline prices are up 22 points this morning to trade at $2.0897.

Markets remain focused on the Iran nuclear deal – the Trump administration will make their final decision on May 12th, just one week from tomorrow. Oil markets will likely remain within the current price range for the next week leading up to the decision.

EIA Price Outlook for 2019

With budget season quickly approaching, it’s time to get an idea of where fuel prices are estimated to be next year. The EIA expects U.S regular gasoline retail prices to average $2.61 and diesel fuel to average $2.90 for 2019. EIA also forecasts Brent spot prices to average about $63/bbl in both 2018 and 2019 while West Texas Intermediate (WTI) crude oil prices will average $4/bbl lower than Brent prices in both 2018 and 2019. These estimates are calculated by the EIA and are adjusted monthly.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.