Today’s Market Trend

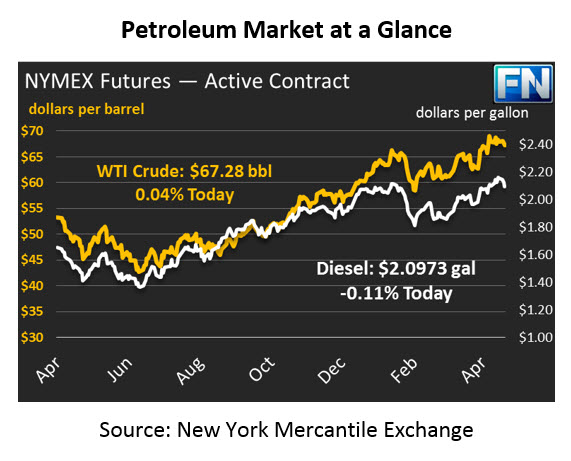

Prices are trading mixed across the oil complex this morning. Crude traded sharply lower yesterday, losing $1.31 to close the day at its lowest price in 2 weeks. A strong US dollar combined with builds reported by the API in both crude and Cushing inventories put downward pressure on crude during yesterday’s trading session. This morning, crude is trading mostly flat, but remaining in positive territory at $67.28.

Refined fuels are tracking lower this morning. Diesel prices lost nearly 5 cents on Tuesday, despite a large inventory draw reported by the API. Gasoline also took a large fall yesterday, losing almost 4.5 cents. This morning diesel is trading mostly flat, down just 24 points to trade at $2.0973. Gasoline has declined more drastically than diesel, moving 1.62 cents lower this morning to trade at $2.0714.

The API reported mixed results yesterday. Crude inventories saw a build of 3.4 MMbbls, a much larger build than the 0.7 expected by the market. Product inventories moved in different directions with gasoline building by 1.6MMbbls, while diesel drew by a large 4.1 MMbbls. The market is anticipating the EIA report that will be released later this morning. If the EIA confirms the build in crude, prices will likely remain bearish.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.