Today’s Market Trend

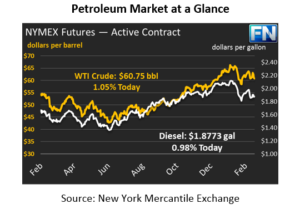

Oil markets fell across the board Thursday continuing this week’s trend lower. Crude prices lost $1.21 yesterday after the dollar moved higher, closing the day below $61/bbl. Crude prices made steady gains over night, gaining 63 cents (1.05%) to trade at $60.75 currently. Despite strength in prices this morning, crude is set to end the week lower overall.

Refined products posted moderate losses yesterday, tracking crude lower. Diesel gave up 1.86 cents to close the day at $1.8591. Gasoline posted a large loss of 5 cents, closing at $1.8677. Both products, however, are moving higher this morning. Diesel prices gained 1.82 cents (.98%) and is currently trading at $1.8773. Gasoline prices are $1.8832, 1.55 cents (.83%) above yesterday’s closing price.

President Trump announced last Thursday that he planned to impose heavy tariffs on both steel and aluminum imports. This Thursday, the President signed these tariffs into place, imposing a tax of 25% on steel imports and 10% on aluminum imports. In OPEC news, the energy minister from Saudi Arabia commented that OPEC cannot reintroduce supply all at one time after the expiration of the OPEC deal. Doing so would potentially flood the market with product during Q1, a time when demand is seasonally weak.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.